What Are The 4 Most Common Types Of Commercial Insurance?

When it comes to protecting your business, having the right insurance coverage is essential. But with so many options available, it can be overwhelming to determine which types of commercial insurance you actually need. Did you know that there are four main types of commercial insurance that are commonly used by businesses across various industries? These insurance policies provide coverage for different aspects of your business, ensuring that you are protected from potential risks and liabilities. Let’s explore what these four types of commercial insurance are and why they are important for your business.

Commercial insurance plays a crucial role in safeguarding businesses against financial losses resulting from unexpected events such as accidents, property damage, or legal claims. The four most common types of commercial insurance are general liability insurance, property insurance, workers’ compensation insurance, and commercial auto insurance. General liability insurance protects businesses from third-party claims for bodily injury or property damage. Property insurance covers damage to your business property caused by events like fire, theft, or natural disasters. Workers’ compensation insurance provides benefits to employees who suffer work-related injuries or illnesses. And commercial auto insurance protects your company vehicles and drivers in case of accidents or damage. By having these essential insurance coverages in place, you can protect your business, employees, and assets from unforeseen circumstances and focus on what you do best: running your business.

Commercial insurance plays a vital role in protecting businesses from potential risks and liabilities. The four most common types of commercial insurance include general liability insurance, property insurance, commercial auto insurance, and workers’ compensation insurance. General liability insurance provides coverage for accidents, injuries, and property damage. Property insurance protects against damage to buildings and contents. Commercial auto insurance covers company vehicles. Workers’ compensation insurance provides coverage for employee injuries and medical expenses. Ensure your business is safeguarded by considering these essential insurance policies.

Understanding the Basics of Commercial Insurance

Commercial insurance is a crucial component for businesses of all sizes and industries. It provides protection and financial support in the face of unexpected events that can cause significant damage or liability. With so many different types of commercial insurance available, it can be overwhelming to determine which policies are essential for your business. In this article, we will explore the four most common types of commercial insurance and how they can safeguard your business.

1. General Liability Insurance

General liability insurance is a foundational policy that every business, regardless of size or industry, should have in place. It provides coverage for claims related to third-party bodily injury, property damage, and personal injury. With general liability insurance, you are protected against legal expenses, medical costs, and potential settlements or judgments that may arise from these types of claims.

In addition to physical harm, general liability insurance also protects against claims of slander, libel, false advertising, and copyright infringement. Having this coverage in place allows you to focus on your business operations with the peace of mind that you are protected from potential lawsuits and financial loss.

General liability insurance is particularly important for businesses that interact with customers, clients, or the general public. This includes retail stores, restaurants, contractors, and professional service providers. It is also often a requirement when entering into contracts with other businesses or when leasing commercial space.

By having general liability insurance, you can protect your business’s assets and reputation, and ensure its long-term growth and success.

2. Property Insurance

Property insurance is essential for businesses that own or lease physical property, such as buildings, equipment, and inventory. This type of insurance provides coverage for damages or losses resulting from events such as fires, storms, vandalism, theft, and other covered perils.

Property insurance not only covers the cost of repairing or replacing damaged property but also provides coverage for business interruption. If your business operations are temporarily halted due to a covered event, property insurance can compensate for lost income and ongoing expenses, such as rent, payroll, and utilities.

It is important to note that property insurance typically has specific coverage limits and exclusions, so it’s crucial to carefully review your policy to ensure adequate protection. Additionally, businesses located in areas prone to certain risks, such as floods or earthquakes, may need to purchase separate policies to cover those specific perils.

Property insurance is essential for any business that relies on physical assets to operate and generate revenue. It provides the necessary financial support to recover from unexpected events and resume business operations.

3. Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is crucial for businesses that provide professional advice, services, or expertise. It protects against claims of negligence, errors, or omissions that result in financial harm to clients or customers.

Professional liability insurance is particularly important for professionals such as doctors, lawyers, architects, consultants, and accountants, as their work has a direct impact on the well-being and financial standing of their clients. If a client alleges that your professional services caused them financial loss, professional liability insurance can cover the costs of legal defense, settlements, or judgments.

Even the most experienced and conscientious professionals can make mistakes or face unfounded claims. Professional liability insurance provides a safety net that allows you to continue working confidently, knowing that you are protected from potential legal and financial consequences.

It is important to note that professional liability insurance policies can vary significantly depending on the industry and the specific services provided. It is essential to understand the coverage limits, exclusions, and any additional endorsements or riders that may be necessary for comprehensive protection.

4. Workers’ Compensation Insurance

Workers’ compensation insurance is a legal requirement for most businesses with employees. It provides coverage for medical expenses, disability benefits, and lost wages for employees who suffer work-related injuries or illnesses. This type of insurance not only benefits employees by offering financial support during their recovery but also protects employers from costly lawsuits related to workplace injuries.

Workers’ compensation insurance covers a wide range of work-related injuries and illnesses, including accidents, repetitive strain injuries, and occupational diseases. It also provides coverage for rehabilitation and vocational training to help injured employees return to work.

The specific requirements and regulations governing workers’ compensation insurance vary by state, so it’s important to comply with the laws applicable to your business location. Failure to carry adequate workers’ compensation insurance can result in fines, penalties, and legal repercussions.

By having workers’ compensation insurance, you provide a safe and secure work environment for your employees and demonstrate your commitment to their well-being.

Exploring Additional Essential Commercial Insurance Policies

In addition to the four most common types of commercial insurance mentioned above, there are several other policies that businesses may find necessary or beneficial, depending on their unique needs and industry. These additional policies include:

- Cyber Liability Insurance

- Business Interruption Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Employment Practices Liability Insurance

- Data Breach Insurance

- Commercial Umbrella Insurance

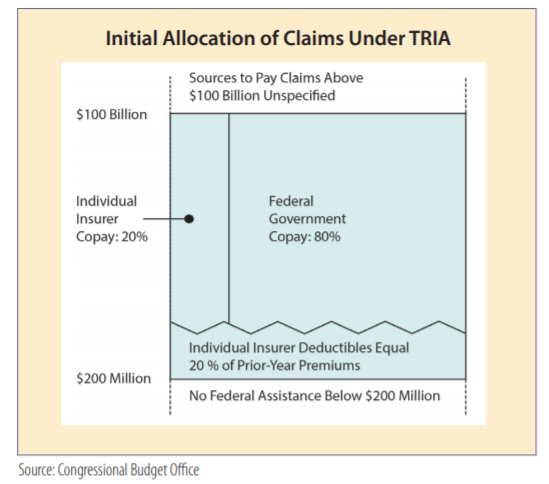

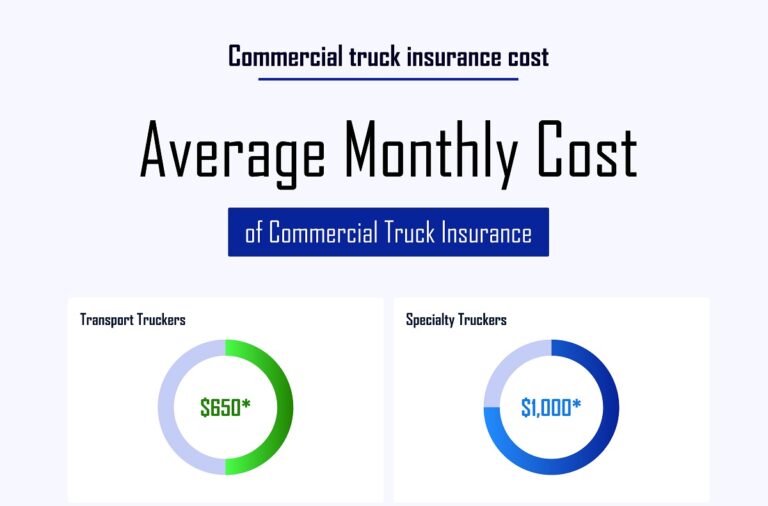

Cyber liability insurance protects businesses from financial losses due to data breaches, hacking, or other cybersecurity incidents. Business interruption insurance covers lost income and ongoing expenses when a business is unable to operate due to a covered event, such as a fire or natural disaster. Commercial auto insurance provides coverage for vehicles owned or used by the business.

Product liability insurance is essential for businesses that manufacture or sell products, as it protects against claims related to product defects or injuries caused by the use of the product. Employment practices liability insurance covers the costs of legal defense and potential settlements or judgments related to claims of employment-related misconduct, such as discrimination or wrongful termination.

Data breach insurance helps businesses respond to and recover from data breaches by covering the costs of notification, credit monitoring, identity theft restoration, and potential legal liabilities. Commercial umbrella insurance provides additional liability coverage beyond the limits of primary policies, offering added financial protection against significant claims or lawsuits.

It is important to evaluate your business’s needs and consult with an insurance professional to determine which additional commercial insurance policies are essential for your specific circumstances.

Conclusion

Commercial insurance is an integral part of risk management for businesses. By understanding the four most common types of commercial insurance – general liability, property, professional liability, and workers’ compensation – you can ensure that your company is protected from potential financial losses and legal liabilities.

The 4 Most Common Types of Commercial Insurance

Commercial insurance is essential for businesses to protect themselves from potential risks and liabilities. Here are the four most common types of commercial insurance:

- General Liability Insurance: Provides coverage for bodily injury, property damage, and advertising injury claims.

- Property Insurance: Protects against damages or loss to the business’s property, including buildings, equipment, and inventory.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job.

- Professional Liability Insurance: Shields professionals from claims of negligence or mistakes in their services.

Having these types of insurance policies in place can help safeguard businesses from financial hardships caused by unexpected incidents, accidents, or lawsuits. It is important for businesses to carefully assess their specific needs and consult with insurance professionals to determine the appropriate coverage for their industry and size.

Key Takeaways

- General Liability Insurance protects businesses from common accidents and lawsuits.

- Property Insurance covers damage or loss of physical assets and property.

- Workers’ Compensation Insurance provides medical and wage benefits to employees injured on the job.

- Commercial Auto Insurance covers damages from accidents involving company-owned vehicles.

- Business Interruption Insurance compensates for lost income and expenses during unexpected disruptions.

Frequently Asked Questions

Here are some frequently asked questions about the four most common types of commercial insurance:

1. What is general liability insurance and why is it important for businesses?

General liability insurance provides coverage for third-party bodily injury, property damage, and personal injury claims. It protects businesses from legal and financial liabilities that may arise from accidents, injuries, or property damage caused by their operations. This type of insurance is important for businesses to prevent financial losses and to ensure that they can afford legal representation in case of lawsuits.

General liability insurance is crucial for businesses as it helps protect assets, reputation, and employee morale. It demonstrates a commitment to customer safety and can also fulfill contractual requirements, ensuring that businesses secure partnerships and contracts with peace of mind.

2. What does property insurance cover and why do businesses need it?

Property insurance covers the physical assets of a business including buildings, equipment, inventory, and other items. It provides financial protection against damage or loss due to events like fire, theft, vandalism, and natural disasters. Businesses need property insurance to safeguard their investments and ensure continuity of operations in the event of unexpected damage or loss.

Property insurance is essential for businesses as it helps them recover from unforeseen events and minimize the financial impact of property damage. It also provides coverage for business interruption, allowing businesses to continue operating even during a temporary shutdown or relocation.

3. What is professional liability insurance and why should professionals have it?

Professional liability insurance, also known as errors and omissions insurance, covers professionals against claims of negligence, errors, or omissions in providing professional services. It protects professionals such as doctors, lawyers, consultants, and architects from legal actions taken by clients who suffer financial losses due to their professional advice or services.

Professionals should have liability insurance as it safeguards their personal and professional reputation, provides financial protection in case of claims or lawsuits, and fulfills contractual requirements. Having professional liability insurance also enhances trust and credibility with clients, assuring them that they are protected in case of any professional mistakes or negligence.

4. What does commercial auto insurance cover and why is it necessary?

Commercial auto insurance covers vehicles used for business purposes, including company-owned vehicles and employee-owned vehicles used for business operations. It provides protection against accidents, third-party liability claims, and damages to the vehicles. Commercial auto insurance is necessary to comply with legal requirements, protect assets, and mitigate financial risks.

Commercial auto insurance is essential for businesses as it ensures that they can continue their operations even after a vehicular accident, protects against potential lawsuits, and provides financial coverage for vehicle repairs or replacements. It also demonstrates responsible business practices and a commitment to safety, which can enhance customer trust and confidence.

What Types of Commercial Insurance Do I Need for My Business?

To conclude, there are four main types of commercial insurance that businesses commonly need. These include general liability insurance, property insurance, business interruption insurance, and workers’ compensation insurance.

General liability insurance helps protect businesses from third-party claims of bodily injury or property damage. Property insurance provides coverage for physical assets such as buildings, equipment, and inventory. Business interruption insurance offers financial protection in case a business is unable to operate due to a covered event, such as a fire or natural disaster. Lastly, workers’ compensation insurance is essential for businesses to provide coverage for employees’ medical expenses and lost wages in case of a work-related injury or illness.