Which Of The Following Is True Regarding Risk Management?

Hey there! Ready to dive into the world of risk management? Well, buckle up because we’re about to explore some interesting facts and truths about this crucial field. So, which of the following is true regarding risk management? Let’s find out!

When it comes to risk management, there are a few key things you need to know. First off, it’s all about identifying and assessing potential risks that could impact an organization’s objectives. This means analyzing both internal and external factors that could lead to unwanted consequences. From financial risks to operational hazards, risk management covers a wide range of possibilities.

But that’s not all! Risk management also involves developing strategies to mitigate, transfer, or even accept certain risks. It’s about finding the right balance between taking calculated risks and ensuring the overall well-being of the organization. So, whether you’re a business owner, a project manager, or just someone curious about risk management, understanding its true nature is essential.

In the next paragraphs, we’ll delve deeper into the various aspects of risk management and explore its benefits, challenges, and best practices. So, stick around and get ready to enhance your knowledge about this fascinating subject!

Keywords: risk management, identifying risks, assessing risks, potential consequences, internal factors, external factors, financial risks, operational hazards, mitigate risks, transfer risks, accept risks, calculated risks, organization’s objectives, benefits, challenges, best practices.

Which of the Following is True Regarding Risk Management?

Understanding Risk Management

Risk management is an essential aspect of any business or organization. It involves identifying, assessing, and mitigating potential risks that could affect the achievement of objectives or the overall success of a project. By implementing effective risk management strategies, businesses can minimize potential losses, protect their assets, and make informed decisions to navigate uncertain situations.

One of the key principles of risk management is the recognition that risks are inherent in any business endeavor. Whether it’s a financial investment, a construction project, or a product launch, there will always be factors that could pose a threat to its success. Risk management aims to proactively identify and address these risks, ensuring that the necessary measures are in place to prevent or minimize their impact.

The Importance of Risk Identification

When it comes to risk management, the first step is identifying potential risks. This involves a systematic process of evaluating the internal and external factors that could impact the project or business operations. By thoroughly understanding the risks, organizations can develop appropriate strategies to deal with them effectively.

One of the true aspects regarding risk management is that it helps businesses anticipate and prepare for potential risks. By conducting a comprehensive risk assessment, organizations can identify the areas that are most vulnerable and prioritize their efforts accordingly. This allows them to allocate resources effectively and implement measures to mitigate the identified risks.

The Role of Risk Assessment

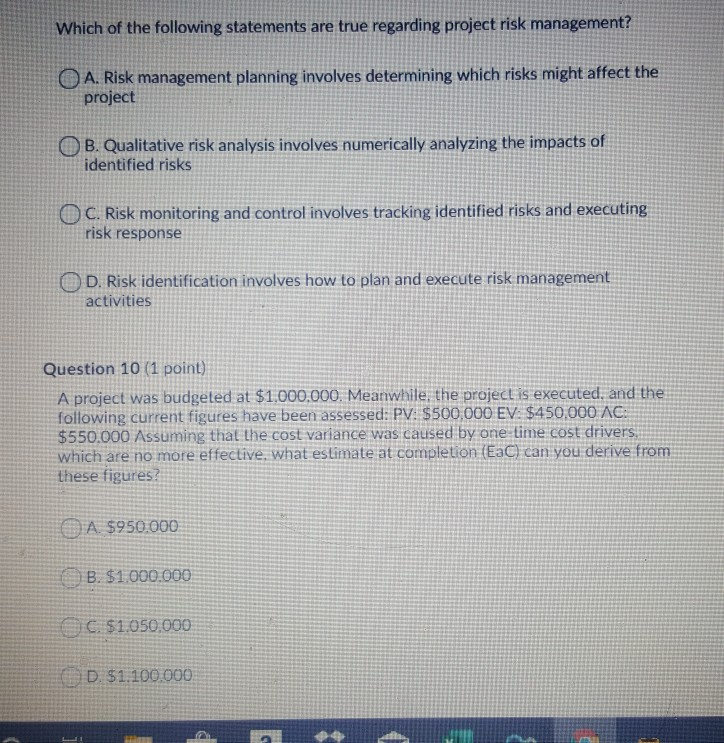

Risk assessment is a critical component of risk management. It involves evaluating the likelihood and potential impact of identified risks. By quantifying and qualifying risks, organizations can prioritize their response and develop appropriate risk mitigation strategies.

A true aspect of risk management is that it enables organizations to make informed decisions based on a thorough understanding of the risks involved. By assessing the potential consequences and probabilities of various risks, businesses can weigh the potential benefits against the potential losses. This allows them to make calculated decisions and take actions that align with their overall objectives.

The Benefits of Risk Mitigation

Risk mitigation is the process of implementing strategies to reduce the likelihood or impact of identified risks. By addressing risks proactively, organizations can minimize the negative consequences and protect their interests. Effective risk mitigation strategies can help businesses maintain their competitive advantage, safeguard their assets, and ensure the continuity of operations.

One of the true aspects of risk management is that it allows businesses to take advantage of opportunities while minimizing potential risks. By identifying and addressing risks, organizations can leverage their strengths and seize opportunities with confidence. This strategic approach enables businesses to achieve sustainable growth and maintain a competitive edge in the market.

Tips for Effective Risk Management

Implementing effective risk management practices can significantly benefit organizations. Here are some essential tips for successful risk management:

- Establish a risk management framework: Develop a clear and structured approach to managing risks, including defined roles and responsibilities.

- Regularly assess risks: Conduct periodic risk assessments to identify new risks, reassess existing risks, and update risk mitigation strategies accordingly.

- Communicate and collaborate: Foster a culture of risk awareness and encourage open communication among team members to ensure everyone understands their role in managing risks.

- Monitor and review: Continuously monitor and review the effectiveness of risk mitigation strategies to identify areas for improvement and make necessary adjustments.

Conclusion

Risk management is a crucial aspect of business operations. By identifying, assessing, and mitigating potential risks, organizations can minimize losses, protect their assets, and make informed decisions. Understanding the true aspects of risk management helps businesses navigate uncertain situations and achieve their objectives with confidence.

Key Takeaways: Which of the following is true regarding risk management?

- Proper risk management helps businesses identify and mitigate potential threats.

- Risk management involves assessing the likelihood and impact of risks.

- Effective risk management strategies can minimize losses and maximize opportunities.

- Risk management is an ongoing process that requires regular monitoring and updating.

- Successful risk management involves proactive planning and implementing preventive measures.

Frequently Asked Questions

Risk management is an essential aspect of any business operation. It involves identifying, assessing, and addressing potential risks that could impact the achievement of organizational objectives. Here are some commonly asked questions about risk management:

1. What is the purpose of risk management?

Risk management aims to protect the organization from potential threats and uncertainties that could hinder its success. By identifying and assessing risks, organizations can develop strategies to mitigate or eliminate them, ensuring the continuity and stability of their operations. Effective risk management also allows businesses to make informed decisions, allocate resources efficiently, and enhance overall performance.

Furthermore, risk management helps organizations comply with legal and regulatory requirements, safeguard their reputation, and maintain trust with stakeholders. It provides a structured approach to proactively manage risks, enabling businesses to adapt to changing environments and capitalize on opportunities.

2. What are the key steps in the risk management process?

The risk management process typically involves the following steps:

1. Risk Identification: This step involves identifying and documenting potential risks that may affect the organization’s objectives. It includes analyzing internal and external factors, conducting risk assessments, and gathering relevant data.

2. Risk Assessment: Once risks are identified, they are assessed to determine their potential impact and likelihood of occurrence. This step involves evaluating the severity of each risk and prioritizing them based on their significance.

3. Risk Mitigation: In this step, strategies and controls are developed to reduce or eliminate identified risks. Mitigation measures may include implementing preventive measures, transferring risks through insurance, or developing contingency plans.

4. Risk Monitoring and Review: Risk management is an ongoing process. It requires continuous monitoring of identified risks, evaluating the effectiveness of mitigation measures, and updating risk assessments as necessary. Regular reviews help ensure that risk management strategies remain relevant and aligned with organizational objectives.

3. Who is responsible for risk management?

Risk management is a collective responsibility that involves various stakeholders within an organization. While senior management plays a crucial role in setting the risk management framework and providing oversight, every individual within the organization has a responsibility to identify and report risks. Risk management departments or committees are often established to coordinate and facilitate the risk management process.

Furthermore, external professionals such as risk consultants, auditors, and legal advisors may be involved to provide specialized expertise and guidance. Effective risk management requires collaboration and communication across different levels and functions of the organization.

4. What are the benefits of implementing risk management?

Implementing risk management brings several benefits to organizations, including:

1. Increased Decision-Making Accuracy: By considering potential risks, organizations can make more informed and accurate decisions, minimizing the likelihood of negative outcomes.

2. Enhanced Operational Efficiency: Identifying and addressing risks helps streamline processes, optimize resource allocation, and reduce operational disruptions or losses.

3. Improved Stakeholder Confidence: Effective risk management demonstrates the organization’s commitment to managing uncertainties and protecting stakeholders’ interests, enhancing trust and confidence.

4. Regulatory Compliance: Adequate risk management practices ensure compliance with legal and regulatory requirements, reducing the organization’s exposure to penalties and reputational damage.

5. Competitive Advantage: Organizations that effectively manage risks are better equipped to seize opportunities, adapt to changes, and gain a competitive edge in the market.

5. Is risk management a one-time process?

No, risk management is an ongoing process that requires continuous monitoring, evaluation, and adaptation. Risks are dynamic and can evolve over time, influenced by internal and external factors. Therefore, organizations need to regularly review and update their risk management strategies to ensure their effectiveness and alignment with changing circumstances.

By constantly assessing and addressing risks, organizations can proactively manage uncertainties, minimize potential impact, and maintain a resilient and sustainable operation.

What is Risk Management? | Risk Management process

Final Summary: What’s True about Risk Management?

When it comes to risk management, there are a few important truths we should keep in mind. Firstly, risk management is a crucial aspect of any organization or business. It involves identifying potential risks, assessing their impact, and implementing strategies to mitigate them. This proactive approach helps to protect against potential harm and ensure the smooth operation of the company.

Secondly, risk management is not a one-time task but an ongoing process. Risks can arise at any time, and it’s essential to regularly review and update risk management strategies to stay ahead. By continuously monitoring the changing landscape, organizations can adapt and respond effectively to new challenges and opportunities.

Lastly, risk management is a collaborative effort. It involves cooperation and coordination among various stakeholders, including management, employees, and external partners. By working together, sharing knowledge and expertise, organizations can develop comprehensive risk management plans that address the diverse range of risks they may face.

In conclusion, risk management is a critical practice that requires ongoing attention and collaboration. By embracing risk management principles and implementing effective strategies, organizations can safeguard their operations, protect their assets, and navigate uncertainties with confidence. So, remember to prioritize risk management and stay vigilant to ensure the success and sustainability of your ventures.