What Are The Different Types Of Commercial Insurance?

Commercial insurance plays a critical role in protecting businesses from potential risks and liabilities. With a wide range of coverage options available, businesses can safeguard their assets, employees, and operations against unforeseen events. Understanding the different types of commercial insurance is essential in creating a comprehensive risk management strategy that suits the specific needs of a business.

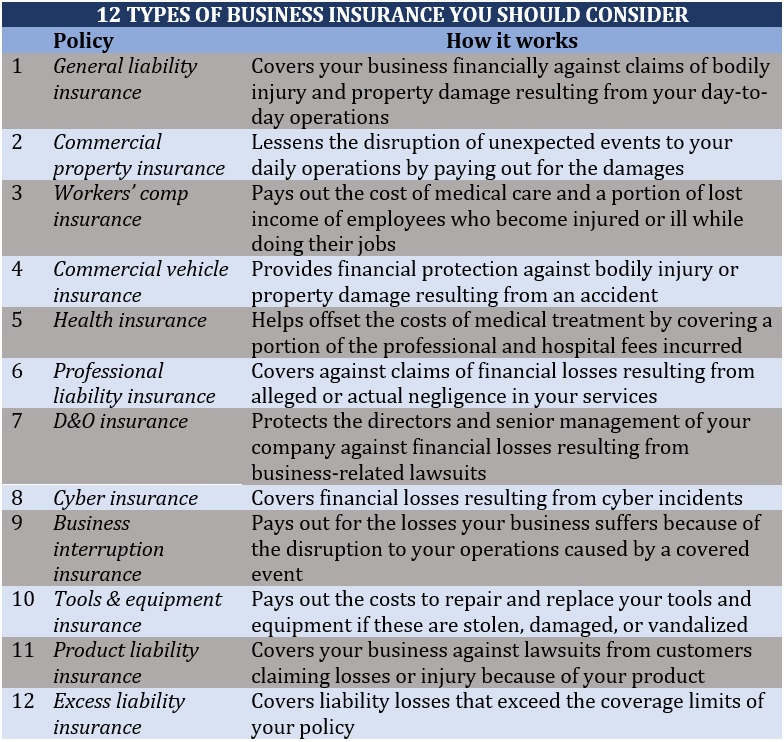

There are several types of commercial insurance that businesses should consider. General liability insurance protects against third-party injuries or property damage, while property insurance covers the physical assets of a business. Worker’s compensation insurance provides coverage for employee injuries, and professional liability insurance protects against claims of professional negligence. Additionally, commercial auto insurance covers vehicles used for business purposes, and cyber liability insurance safeguards against cyber threats and data breaches. By having the right combination of these insurance coverages, businesses can mitigate potential risks and ensure their long-term stability.

Commercial insurance offers a range of coverage options to protect businesses from financial losses. There are several types of commercial insurance, including general liability insurance, property insurance, workers’ compensation insurance, commercial auto insurance, and professional liability insurance. General liability insurance covers third-party bodily injury or property damage claims. Property insurance protects against damage or loss to business property. Workers’ compensation insurance provides coverage for employee injuries or illnesses. Commercial auto insurance covers vehicles used for business purposes. Professional liability insurance safeguards professionals against claims of negligence or errors. Businesses can customize their insurance plans to fit their specific needs.

Understanding the Importance of Commercial Insurance

Commercial insurance is a critical component of any business’s risk management strategy. It provides financial protection against a wide range of potential losses and liabilities that can arise in the course of operating a business. From property damage and liability claims to employee injuries and cyber threats, commercial insurance policies offer coverage tailored to specific risks and industries.

By understanding the different types of commercial insurance available, business owners can make informed decisions about the coverage they need to safeguard their operations. In this article, we will explore some of the key types of commercial insurance and their importance in mitigating risk.

1. Property Insurance

Property insurance is a fundamental coverage that protects businesses against the loss or damage of physical assets, including buildings, equipment, inventory, and furniture. Whether due to fire, theft, vandalism, or natural disasters, property insurance provides compensation for the repair, replacement, or rebuilding of these assets.

In addition to the physical structure and contents of a business, property insurance may also cover other valuable assets such as signage, outdoor fixtures, and fences. It is important to note that property insurance typically does not cover losses caused by floods and earthquakes, which may require separate policies depending on the geographical location.

Having property insurance is essential for businesses of all sizes as it protects one of their most valuable assets. It provides peace of mind knowing that any unexpected damage or loss will be covered, allowing business owners to focus on their operations without the burden of significant financial setbacks.

Furthermore, property insurance is often a requirement by lenders when obtaining financing for a business. Lenders want to ensure that the assets they are financing are adequately protected, reducing the risk of financial loss for both the business owner and the lender.

2. Liability Insurance

Liability insurance protects businesses from financial loss resulting from claims made by third parties for bodily injury, property damage, or personal injury caused by the business or its employees. It covers legal fees, court costs, and any settlements or judgments that may be awarded against the business.

There are several different types of liability insurance, each addressing specific types of risks:

- General liability insurance: Covers claims of bodily injury or property damage arising from the business operations.

- Professional liability insurance: Also known as errors and omissions insurance, it provides coverage for claims of negligence or inadequate work by professionals in various industries like healthcare, legal, and consulting.

- Product liability insurance: Protects manufacturers, wholesalers, and retailers from claims related to product defects or failures resulting in injury or property damage.

- Employment practices liability insurance: Covers claims related to employee discrimination, wrongful termination, harassment, or other employment-related issues.

- Cyber liability insurance: Specifically designed to protect against the financial losses associated with data breaches, cyber-attacks, and other cyber-related incidents.

Liability insurance is crucial for businesses as it provides protection against the unpredictable nature of accidents, mistakes, and claims that may arise from their operations. Without adequate coverage, even a single significant liability claim can jeopardize the financial stability of a business and its ability to continue operations.

3. Workers’ Compensation Insurance

Workers’ compensation insurance is a type of coverage that provides benefits to employees who suffer work-related injuries or illnesses. It is required by law in most states and ensures that employees receive medical care, rehabilitation, and lost wages in the event of a workplace accident.

This insurance coverage is essential for all businesses with employees, regardless of the industry or size. It not only protects employees but also shields employers from potentially costly lawsuits resulting from work-related injuries or illnesses.

Workers’ compensation insurance typically covers medical expenses, disability benefits, and vocational rehabilitation for injured or ill employees. It may also include death benefits to the families of employees who have suffered fatal work-related accidents or illnesses.

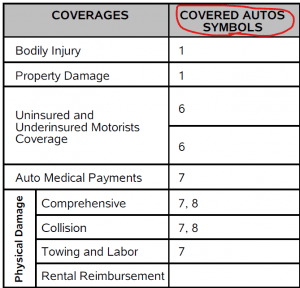

4. Commercial Auto Insurance

Commercial auto insurance provides coverage for vehicles used for business purposes, whether owned or leased by the company. It protects businesses from various risks associated with operating vehicles, including accidents, theft, and damage.

This type of insurance is essential for businesses that own or lease vehicles, whether they are cars, trucks, delivery vans, or any other type of vehicle. Commercial auto insurance typically covers liability for bodily injury and property damage, medical payments, collision, and comprehensive coverage for damage not caused by a collision (e.g., theft, vandalism, weather events).

Without adequate commercial auto insurance, businesses can be exposed to significant financial liabilities in the event of an accident or damage to their vehicles. It provides financial protection and ensures the ability to replace or repair vehicles, keeping the business running smoothly.

In addition to the above types of commercial insurance, businesses may also require other specialized coverages based on their industry. These can include but are not limited to:

- Directors and officers liability insurance

- Errors and omissions insurance

- Business interruption insurance

- Cyber liability insurance

- Employment practices liability insurance

- Product recall insurance

Conclusion

Commercial insurance plays a vital role in protecting businesses from a wide range of risks and liabilities. Through policies such as property insurance, liability insurance, workers’ compensation insurance, and commercial auto insurance, businesses can mitigate financial losses and ensure their long-term viability. It is essential for business owners to assess their specific risks and consult with insurance professionals to determine the appropriate coverage needed to safeguard their operations.

The Various Types Of Commercial Insurance

Commercial insurance is essential for businesses of all sizes and industries. It provides protection against various risks and potential liabilities that could arise in the course of conducting business operations. Here are some of the different types of commercial insurance:

- General Liability Insurance: Covers third-party claims for bodily injury, property damage, or personal injury arising from business activities.

- Property Insurance: Protects business property, including buildings, equipment, inventory, and supplies, against damage or loss.

- Business Interruption Insurance: Provides financial coverage when a business is unable to operate due to unexpected events, such as a fire or natural disaster.

- Workers’ Compensation Insurance: Compensates employees for medical expenses, lost wages, and rehabilitation services in the event of work-related injuries or illnesses.

- Professional Liability Insurance: Offers protection against claims of negligence, errors, or omissions in professional services.

- Cyber Liability Insurance: Safeguards businesses against financial losses resulting from data breaches, cyber attacks, or other cyber-related incidents.

These are just a few examples of the many types of commercial insurance available. The specific insurance needs of a business may vary depending on factors such as industry, location, and size. It is important for businesses to consult with insurance professionals to determine the most suitable coverage options to safeguard their operations and assets.

Key Takeaways: What Are The Different Types Of Commercial Insurance?

- General liability insurance protects businesses against third-party claims of bodily injury or property damage.

- Commercial property insurance covers physical assets like buildings, equipment, and inventory.

- Business interruption insurance provides coverage for lost income and expenses during a temporary closure.

- Professional liability insurance safeguards professionals from claims of negligence or errors in their services.

- Commercial auto insurance protects businesses against accidents and damages involving company vehicles.

Frequently Asked Questions

Commercial insurance is essential for protecting businesses from potential risks and liabilities. Here are some frequently asked questions about the different types of commercial insurance coverage options available:1. What is general liability insurance?

General liability insurance is a type of commercial insurance that provides coverage for third-party bodily injury, property damage, personal injury, and advertising injury claims. It protects businesses from financial losses that may result from lawsuits filed by customers, clients, or other third parties.

This insurance coverage typically includes medical expenses, legal defense costs, and settlements or judgments that the business may be responsible for in the event of a covered claim. General liability insurance is important for businesses that interact with customers or clients, have physical locations, or engage in advertising or marketing activities.

2. What is property insurance?

Property insurance provides coverage for damage to a business’s physical property, including buildings, equipment, inventory, and other assets. It protects against perils such as fire, theft, vandalism, and natural disasters.

In addition to covering the cost of repairing or replacing damaged property, property insurance may also include coverage for business interruption, which reimburses lost income and operating expenses if the business cannot operate due to a covered loss.

3. What is professional liability insurance?

Professional liability insurance, also known as errors and omissions insurance, is designed to protect businesses and professionals who provide advice or services to clients. It covers claims arising from negligence, errors, or omissions that may result in financial loss or damages to clients or third parties.

Professional liability insurance is important for industries such as healthcare, legal, consulting, and technology. It can help with legal defense costs, settlements, and judgments, as well as reputation protection for the business or professional.

4. What is cyber liability insurance?

Cyber liability insurance provides coverage for damages and expenses related to cyber attacks, data breaches, and other cyber risks. It helps businesses recover from cyber incidents by covering costs such as legal fees, notification expenses, credit monitoring for affected individuals, public relations efforts, and potential liability claims.

In today’s digital world, where businesses rely heavily on technology and store sensitive customer data, cyber liability insurance is crucial in protecting against the financial and reputational damage that can result from a cyber incident.

5. What is workers’ compensation insurance?

Workers’ compensation insurance is required by law in most states and provides coverage for employees who suffer work-related injuries or illnesses. It covers medical expenses, rehabilitation costs, and a portion of lost wages for injured or ill employees.

Workers’ compensation insurance not only protects employees, but it also protects businesses from potential lawsuits related to workplace injuries. It ensures that employees receive the necessary medical care and benefits while providing businesses with financial protection.

The Basics of Commercial Insurance!

In conclusion, there are various types of commercial insurance that businesses can consider to protect themselves from financial risks. These include general liability insurance, property insurance, professional liability insurance, and workers’ compensation insurance.

General liability insurance covers legal expenses and damages in case of injuries or property damage caused by the business. Property insurance protects against loss or damage to physical assets such as buildings or equipment. Professional liability insurance provides coverage for errors, negligence, or omissions in professional services. Lastly, workers’ compensation insurance offers benefits to employees who are injured or become ill while on the job.