Tailored Coverage For Your Industry: The Importance Of Specific Industry Insurance

When it comes to protecting your business, one size does not fit all. Tailored coverage for your industry is essential, and that’s where specific industry insurance comes into play. Whether you’re in the construction, healthcare, or hospitality industry, having insurance that is customized to your unique needs can make all the difference. In this article, we will explore the importance of specific industry insurance and why it is crucial for your business’s success.

As a business owner, you understand the risks and challenges that come with operating in your industry. From the potential for accidents and injuries to the specific liability concerns that arise, having insurance that is tailored to your industry can provide you with peace of mind and financial protection. Specific industry insurance takes into account the unique risks associated with your line of work, ensuring that you have the coverage you need when you need it most.

In the following sections, we will delve deeper into the importance of specific industry insurance and discuss the benefits it can offer to businesses in various sectors. So, grab a cup of coffee and get ready to learn why having tailored coverage for your industry is a game-changer. Let’s dive in!

When it comes to insurance, one size does not fit all. Tailored coverage for your industry is crucial for protecting your business from specific risks and liabilities. Whether you’re in the manufacturing, construction, or healthcare industry, having specific industry insurance ensures that you have coverage that meets the unique needs of your business. By understanding the intricacies of your industry, insurers can provide policies that address industry-specific risks, giving you peace of mind and financial protection.

Tailored Coverage for Your Industry: The Importance of Specific Industry Insurance

In today’s rapidly evolving business landscape, it is crucial for companies to protect themselves against potential risks and liabilities. One way to ensure comprehensive protection is by securing tailored coverage for your industry through specific industry insurance. This type of insurance is designed to meet the unique needs and challenges faced by businesses operating in specific sectors, providing them with targeted coverage and peace of mind.

Understanding Specific Industry Insurance

Specific industry insurance, also known as niche insurance, is a specialized form of coverage that caters to the specific needs of businesses operating within a particular industry. Unlike general business insurance, which offers broad coverage for common risks, specific industry insurance is tailored to address the industry-specific risks and liabilities that companies in a particular sector may face. This targeted approach ensures that businesses have coverage that is specifically designed to protect against the unique challenges they encounter.

One of the key advantages of specific industry insurance is that it offers more comprehensive coverage compared to general business insurance. By focusing on the specific risks and liabilities associated with a particular industry, this type of insurance provides businesses with the level of protection they need to thrive in their respective sectors. Whether it’s property damage, product liability, professional errors, or other industry-specific risks, tailored coverage ensures that businesses are adequately protected against potential financial losses.

The Benefits of Tailored Coverage

There are several significant benefits to securing tailored coverage for your industry. First and foremost, specific industry insurance offers businesses peace of mind. Knowing that you have coverage that is specifically designed to address the risks and liabilities unique to your industry provides a sense of security and allows you to focus on running your business without constantly worrying about potential setbacks.

Furthermore, specific industry insurance can help businesses save money in the long run. While some may argue that general business insurance is sufficient, the reality is that it may not offer the level of coverage needed to address industry-specific risks adequately. By investing in tailored coverage, businesses can avoid potential gaps in their insurance coverage and reduce the likelihood of unexpected financial burdens resulting from uncovered liabilities.

Another advantage of specific industry insurance is that it often comes with additional features and benefits that are specifically tailored to the needs of businesses operating in a particular sector. These enhancements can include access to specialized legal assistance, risk management resources, and industry-specific guidance. Having these resources readily available can be invaluable in navigating the unique challenges of your industry and ensuring that your business is well-equipped to handle any potential issues.

The Importance of Specific Industry Insurance

The importance of securing specific industry insurance cannot be overstated. Operating without tailored coverage leaves businesses vulnerable to industry-specific risks that may not be adequately addressed by general business insurance. This can expose companies to significant financial losses and potentially jeopardize their long-term viability.

One of the main reasons why specific industry insurance is essential is that it helps businesses comply with industry regulations and requirements. Many sectors have specific mandates and regulations that businesses must adhere to in order to operate legally. Failure to comply with these requirements can result in severe penalties and legal consequences. By securing tailored coverage, businesses can ensure that they meet all the necessary insurance obligations set forth by regulatory bodies.

Additionally, specific industry insurance provides businesses with a competitive advantage. In industries where risk management and liability coverage are critical, having tailored coverage can set businesses apart from their competitors. Clients and partners are more likely to trust and engage with companies that can demonstrate their commitment to comprehensive risk management through specialized insurance coverage. This can lead to increased opportunities for growth and success within the industry.

The Role of Insurance Brokers

When it comes to securing tailored coverage for your industry, it is highly recommended to work with an experienced insurance broker. Insurance brokers specialize in understanding the unique needs of different industries and can help businesses navigate the complex landscape of insurance options. They have access to a wide range of insurance providers and can negotiate customized coverage that aligns with your business’s specific requirements.

Insurance brokers also provide valuable expertise and guidance throughout the insurance procurement process. They can assess your business’s risks and liabilities, identify any gaps in your current coverage, and recommend appropriate solutions. By leveraging their knowledge and industry connections, insurance brokers can help businesses make informed decisions and secure the most comprehensive coverage available.

In conclusion, tailored coverage for your industry through specific industry insurance is of utmost importance in today’s business landscape. It offers businesses comprehensive protection against industry-specific risks and liabilities, providing peace of mind, cost savings, and a competitive edge. By working with an insurance broker, businesses can navigate the complexities of insurance options and secure customized coverage that meets their specific needs. Don’t leave your business’s future to chance – invest in tailored coverage for your industry today.

Key Takeaways: Tailored Coverage for Your Industry – The Importance of Specific Industry Insurance

- Every industry has unique risks and challenges that require specialized insurance coverage.

- General insurance policies may not provide adequate protection for industry-specific risks.

- Industry-specific insurance helps businesses protect against unique liabilities and financial losses.

- By tailoring coverage to your industry, you can ensure that your business is adequately protected.

- Consulting with an insurance professional who specializes in your industry can help you find the right coverage.

Frequently Asked Questions

What is tailored coverage for your industry?

Tailored coverage refers to insurance policies that are specifically designed to meet the unique needs and risks of a particular industry. Unlike generic insurance plans, tailored coverage takes into account the specific challenges and exposures faced by businesses in a particular industry.

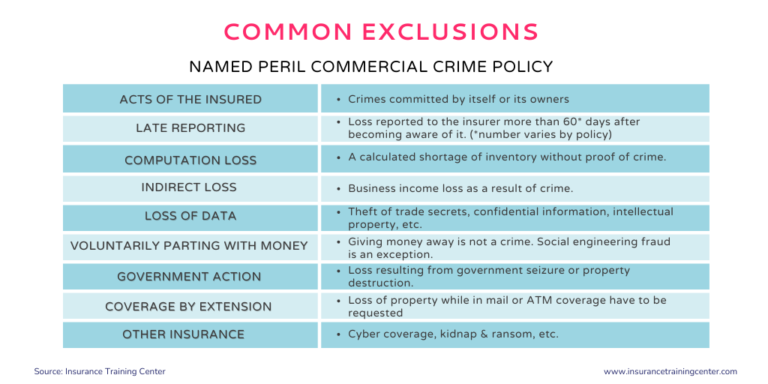

For example, a construction company may require coverage for risks such as accidents on job sites, property damage, and liability claims. On the other hand, a technology company may need coverage for data breaches, intellectual property infringement, and cyber liability. Tailored coverage ensures that businesses have the right protection in place to mitigate industry-specific risks.

Why is specific industry insurance important?

Specific industry insurance is important because it provides businesses with comprehensive coverage that is tailored to their unique needs. Generic insurance plans may not adequately cover the specific risks faced by businesses in a particular industry, leaving them vulnerable to financial losses.

By having insurance that is specifically designed for their industry, businesses can ensure that they have coverage for the risks that are most likely to impact them. This can include coverage for industry-specific liabilities, property damage, equipment breakdowns, and more. Having the right insurance in place can give businesses peace of mind knowing that they are protected against the unique risks of their industry.

How can tailored coverage benefit my business?

Tailored coverage can benefit your business in several ways. Firstly, it provides comprehensive protection against the specific risks faced by your industry. This means that you are less likely to experience financial losses due to uncovered liabilities or damages.

Additionally, tailored coverage can help your business meet industry-specific requirements or regulations. Many industries have specific insurance requirements that businesses must meet in order to operate legally. By having tailored coverage, you can ensure that you are in compliance with these requirements.

Furthermore, having tailored coverage can enhance your reputation and credibility within your industry. It shows that you take your business and its risks seriously, which can be attractive to clients, partners, and investors.

How can I find the right tailored coverage for my industry?

Finding the right tailored coverage for your industry starts with understanding the specific risks and liabilities that are unique to your business. Conduct a thorough risk assessment to identify the areas where your business is most vulnerable.

Once you have a clear understanding of your risks, consult with insurance providers who specialize in your industry. They will have the expertise and knowledge to recommend the appropriate coverage options for your business. Be sure to compare quotes and coverage terms from multiple providers to ensure that you are getting the best value for your insurance.

Can I add tailored coverage to my existing insurance policy?

In some cases, it may be possible to add tailored coverage to your existing insurance policy. However, this will depend on the specific terms and conditions of your policy and the insurance provider you are working with.

It is recommended to consult with your insurance provider to discuss your options. They will be able to advise you on whether it is possible to add tailored coverage to your existing policy or if you would need to purchase a separate policy specifically designed for your industry.

Final Summary: Why Tailored Coverage for Your Industry Matters

When it comes to protecting your business, having the right insurance coverage is crucial. And one type of insurance that often gets overlooked is industry-specific insurance. In this article, we’ve explored the importance of tailored coverage for your industry and why it should be a top priority for any business owner.

By investing in industry-specific insurance, you’re ensuring that your business is protected from the unique risks and challenges that are specific to your industry. Whether you’re in the construction, healthcare, or hospitality sector, having insurance that is tailored to your specific needs can provide you with the peace of mind you deserve.

Not only does industry-specific insurance provide coverage for typical risks such as property damage or liability claims, but it also offers specialized protection that is designed to address the specific risks and challenges faced by businesses in your industry. This can include coverage for equipment breakdowns, professional liability, or even cyber-attacks.

So, don’t overlook the importance of tailored coverage for your industry. It’s not just a luxury, but a necessity for any business owner who wants to protect their investment and ensure their long-term success. Remember, when it comes to insurance, one size does not fit all. Invest in industry-specific coverage and give your business the protection it deserves.

Final Thought: Finding the Right Coverage for Your Industry

In a world where risks and challenges are constantly evolving, having the right insurance coverage