What Is The Best Commercial Auto Insurance?

When it comes to choosing the best commercial auto insurance, there’s one surprising fact that stands out – not all policies are created equal. With the increasing number of vehicles on the road and the higher risks involved in commercial operations, finding the right insurance coverage is crucial. But what exactly makes a policy the best option for your business?

In order to determine the best commercial auto insurance, it’s important to consider several factors. Firstly, a comprehensive policy that covers both liability and property damage is essential to protect your business in the event of an accident. Secondly, a reliable and responsive insurance provider is crucial for efficient claims processing. Lastly, a competitive premium rate that suits your budget is a key consideration. By assessing these aspects and finding the right balance, you can ensure that you have the best commercial auto insurance coverage for your business needs.

When it comes to finding the best commercial auto insurance, there are a few key factors to consider. Firstly, look for comprehensive coverage that protects your business vehicles against damages, theft, and accidents. Secondly, consider the provider’s reputation and financial strength to ensure they can handle claims efficiently. Thirdly, compare the policy terms, including deductibles, limits, and exclusions. Additionally, consider the customer service and support offered by the insurance company. By evaluating these factors, you can make an informed decision and find the best commercial auto insurance that suits your business needs.

Understanding the Importance of Commercial Auto Insurance

Running a business often requires the use of vehicles for various purposes such as transporting goods, making deliveries, or providing services. With the increasing number of vehicles on the road and the potential risks involved, it is crucial for businesses to protect themselves with the best commercial auto insurance. Commercial auto insurance provides coverage for vehicles used in business operations, offering financial protection in the event of an accident, damage, theft, or third-party liability claims.

Factors to Consider When Choosing Commercial Auto Insurance

When it comes to choosing the best commercial auto insurance, several factors need to be considered to ensure that you are adequately protected:

- Type of coverage: Determine the type and level of coverage your business needs. This may include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage.

- Insurance company reputation: Research the insurance company’s reputation, financial stability, and customer service record. Look for companies with a strong track record of handling claims and providing excellent customer support.

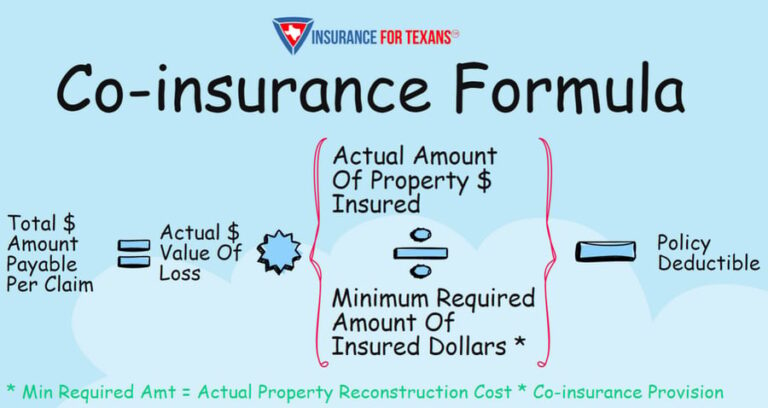

- Premium costs: Compare premiums from different insurance providers and choose one that offers competitive rates for the coverage you require. Be sure to consider the deductible amount and how it affects the cost.

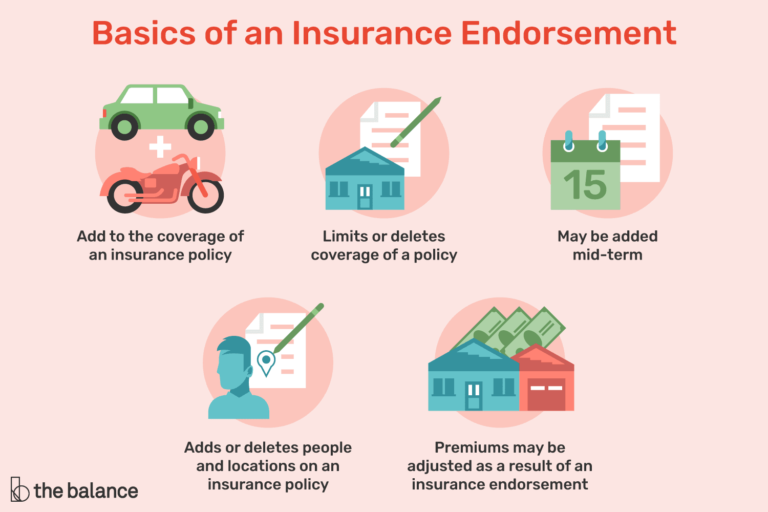

- Policy customization: Look for a commercial auto insurance policy that can be tailored to your specific business needs. Customization options may include adding endorsements, increasing coverage limits, or including additional insured parties.

- Claims process: Consider the ease and efficiency of the insurance company’s claims process. Look for companies with dedicated claims representatives who can guide you through the process and ensure a smooth resolution.

Determining Coverage Limits

When determining your commercial auto insurance coverage limits, it is essential to consider the potential risks and liabilities your business may face:

- Asset value: Evaluate the total value of your business’s vehicles and other assets. Consider the potential cost of repair or replacement in the event of an accident or theft.

- Potential liabilities: Assess the potential liabilities your business may face. This could include bodily injury or property damage claims from accidents involving your vehicles.

- Industry regulations: Consider any industry-specific or state-specific requirements for commercial auto insurance coverage limits.

- Business size and operations: Evaluate the size and scope of your business operations. Larger businesses may require higher coverage limits to protect against potential risks.

Additional Coverage Options

Aside from the standard coverage options, there are additional coverage options you may want to consider for your commercial auto insurance policy:

- Hired and non-owned auto coverage: If your business involves renting or using vehicles that are not owned by your company, this coverage can protect you in the event of accidents or damages.

- Equipment breakdown coverage: This coverage helps cover the costs of repairs or replacement of equipment in your vehicles in case of mechanical breakdowns.

- Roadside assistance coverage: Having this coverage can provide peace of mind knowing you have access to emergency services such as towing, battery jump-starts, and tire changes.

- Loss of earnings coverage: In the event of an accident that renders your vehicles inoperable, this coverage can help compensate for the loss of business income during the repair or replacement period.

Managing Commercial Auto Insurance Premiums

There are several strategies you can employ to manage your commercial auto insurance premiums:

- Safe driving practices: Encourage safe driving habits among your employees by implementing training programs and providing incentives for accident-free records.

- Vehicle maintenance: Regularly maintain and service your vehicles to reduce the likelihood of breakdowns or accidents caused by mechanical issues.

- Loss control measures: Implement safety measures such as installing vehicle tracking systems, antitheft devices, and driver monitoring systems to mitigate risks and potentially lower premiums.

- Shop around for the best rates: Periodically review your commercial auto insurance policy and obtain quotes from multiple insurance providers to ensure you are getting the best rates for your coverage needs.

Understanding Policy Exclusions and Limitations

While commercial auto insurance provides necessary coverage for businesses, it is important to understand the policy exclusions and limitations:

Common Exclusions in Commercial Auto Insurance

- Intentional acts: Commercial auto insurance does not cover intentional acts of damage or harm caused by the policyholder.

- Personal use: If a vehicle covered by a commercial auto insurance policy is used for personal purposes, any resulting accidents or damages may not be covered.

- Uninsured or underinsured motorists: Some commercial auto insurance policies may not provide coverage for accidents involving uninsured or underinsured motorists unless specifically added to the policy.

- Racing or illegal activities: Accidents or damages resulting from racing, illegal activities, or violation of traffic laws may not be covered by commercial auto insurance.

Coverage Limitations in Commercial Auto Insurance

- High-value items: Commercial auto insurance may have limitations on coverage for high-value items such as specialized equipment or valuable cargo.

- Employee personal vehicles: If an employee uses their personal vehicle for business purposes, it may not be fully covered under the company’s commercial auto policy. Additional coverage may be needed.

- Geographical limitations: Some insurance policies may have geographical limitations, meaning coverage may not extend to certain areas or outside the usual business operating region.

Working with an Insurance Professional

Selecting the best commercial auto insurance policy for your business can be challenging. Working with an insurance professional who specializes in commercial insurance can provide valuable guidance and support. An insurance professional can assess your business needs, review policy options, and help you find the coverage that offers the best protection for your specific operations.

Remember that commercial auto insurance is an essential investment to safeguard your business and mitigate financial risks associated with vehicular accidents, damages, theft, or liability claims. By understanding the factors to consider, coverage options, and policy limitations, you can make an informed decision and choose the best commercial auto insurance policy for your business.

Best Commercial Auto Insurance

When it comes to finding the best commercial auto insurance, there are several factors to consider. Here are some key points to keep in mind:

- Reputation: Look for an insurance provider with a strong reputation in the industry and positive customer reviews.

- Coverage: The best commercial auto insurance will offer comprehensive coverage that meets the specific needs of your business.

- Cost: While affordability is important, it’s also crucial to consider the overall value and coverage provided for the price.

- Claims Process: A good insurance provider will have a smooth and efficient claims process, ensuring that any damages or losses are taken care of promptly.

- Customer Service: Look for a company that offers excellent customer service and is easily accessible for any inquiries or assistance.

Ultimately, the best commercial auto insurance will vary depending on your specific business needs, location, and other individual factors. It’s important to carefully research and compare different insurance providers to find the one that offers the best combination of coverage, affordability, and customer service.

Key Takeaways: What Is The Best Commercial Auto Insurance?

- Consider the reputation and financial stability of the insurance company.

- Compare coverage options and review the policy exclusions.

- Evaluate the claims process and customer service of the insurance provider.

- Assess the cost of the insurance premium and deductibles.

- Look for additional benefits such as roadside assistance or rental reimbursement.

Frequently Asked Questions

Choosing the best commercial auto insurance is crucial for businesses, as it provides coverage for their vehicles and protects them from potential financial losses. To help you make an informed decision, here are answers to some frequently asked questions about commercial auto insurance.

1. What factors should I consider when looking for the best commercial auto insurance?

When searching for the best commercial auto insurance, there are several factors you should consider:

Firstly, assess your business’s specific needs and the type of vehicles you own. Ensure that the insurance policy covers all the necessary vehicles and provides adequate coverage for your business operations.

Secondly, consider the reputation and financial stability of the insurance provider. Look for a company with a strong track record, excellent customer reviews, and a good claims settlement record.

Lastly, compare quotes from multiple insurance providers to ensure you find the best coverage at a competitive price.

2. What does commercial auto insurance cover?

Commercial auto insurance typically covers:

– Liability coverage: This covers bodily injury and property damage caused by your vehicles in an accident.

– Collision coverage: This covers damage to your vehicles in case of a collision.

– Comprehensive coverage: This covers non-collision-related damages, such as theft, vandalism, or damage due to natural disasters.

– Medical payments coverage: This covers medical expenses for you and your passengers in case of an accident.

– Uninsured/underinsured motorist coverage: This protects you if you are involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

3. Are there any exclusions in commercial auto insurance policies?

Commercial auto insurance policies often have exclusions that are not covered under the policy. Some common exclusions include:

– Intentional acts: Damage caused intentionally by the insured party is not covered.

– Employee injuries: Workers’ compensation insurance typically covers injuries to employees, not commercial auto insurance.

– Personal use: Commercial auto insurance only covers vehicles used for business purposes, not personal use.

– Racing or competition: Commercial auto insurance generally does not cover vehicles used for racing or competition purposes.

4. How can I lower the cost of commercial auto insurance?

To lower the cost of commercial auto insurance, you can take the following steps:

– Opt for higher deductibles: Increasing your deductible can help reduce premiums.

– Improve safety measures: Implementing safety features in your vehicles, such as anti-theft devices or dashcams, can lower insurance costs.

– Maintain a clean driving record: Ensuring your drivers maintain a good driving record can help lower insurance premiums.

– Bundle insurance policies: Consolidating your commercial auto insurance with other business policies, such as general liability insurance, can often result in discounted rates.

5. Should I choose a specialized insurance provider for commercial auto insurance?

Choosing a specialized insurance provider for commercial auto insurance can be beneficial. They understand the specific needs and risks associated with commercial vehicles, and they may offer better coverage options tailored to your business. However, it’s still important to evaluate multiple providers and compare their offerings to ensure you find the best insurance for your business.

Best Commercial Auto Insurance 🇺🇸 [TOP 10] | Affordable Commercial Vehicle Insurance 🚛 USA

When it comes to finding the best commercial auto insurance, there are several factors to consider. One of the most important aspects is the coverage offered by the insurance provider. It is crucial to ensure that the policy provides adequate coverage for the specific needs of the business, including liability coverage, collision coverage, and comprehensive coverage.

Another key factor to consider is the reputation and financial stability of the insurance company. It’s essential to choose a reputable insurer with a strong track record of providing quality coverage and excellent customer service. Additionally, it’s wise to review customer reviews and ratings to gauge the experiences of other businesses with the insurance company.