Unveiling Policy Enhancements: Understanding Policy Endorsements

Unveiling Policy Enhancements: Understanding Policy Endorsements

Hey there! Are you ready for a deep dive into the world of insurance policies? Well, hold on tight because today we’re going to unravel the mysteries behind policy endorsements. Now, I know what you’re thinking, “What on earth is a policy endorsement?” Don’t worry, my friend, I’ve got you covered.

Picture this: you’ve just purchased an insurance policy to protect your most valuable possessions. Everything seems hunky-dory until you come across the term “policy endorsement.” It sounds fancy, but what does it actually mean? Essentially, a policy endorsement is like adding a little extra spice to your insurance coverage. It’s a way to tailor your policy to your specific needs, giving you that extra peace of mind.

Now, let’s get into the nitty-gritty details. Policy endorsements can come in many forms, from adding coverage for a specific risk to modifying the terms and conditions of your policy. It’s like customizing your insurance plan to fit like a glove. But how do you know which endorsements are right for you? That’s where we come in! We’re here to guide you through the ins and outs of policy endorsements, helping you make informed decisions that truly protect what matters most to you.

So, buckle up and get ready to uncover the secrets behind policy endorsements. We’ll break down the different types, explain how they work, and even share some insider tips on optimizing your

Policy endorsements are an important aspect of insurance policies. They are modifications or additions to the policy that can enhance coverage or provide additional benefits. Understanding policy endorsements is crucial for policyholders to ensure they have the right coverage for their needs. By reviewing the endorsements, policyholders can identify any gaps in coverage and make informed decisions about their insurance policies. It’s important to consult with an insurance professional to fully understand the implications of policy endorsements and how they can affect your coverage.

Unveiling Policy Enhancements: Understanding Policy Endorsements

Policy endorsements are a crucial aspect of insurance policies that can greatly affect coverage and policyholder benefits. Understanding policy endorsements is essential for policyholders to ensure they have the appropriate coverage for their needs. In this article, we will delve into the intricacies of policy endorsements, exploring their purpose, types, and how they impact insurance policies.

What are Policy Endorsements?

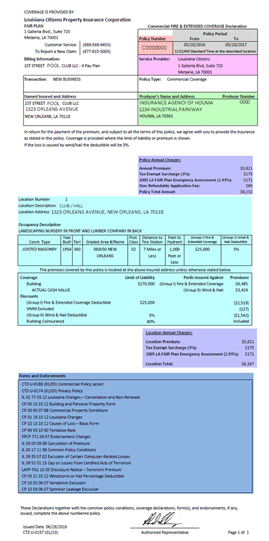

Policy endorsements, also known as riders or add-ons, are modifications made to an insurance policy that alter its terms or conditions. These modifications can be used to extend or restrict coverage, add additional features, or clarify certain aspects of the policy. Policy endorsements are typically requested by the policyholder or recommended by the insurer to meet specific coverage requirements or address unique circumstances.

Policy endorsements are a way for insurers to customize insurance policies to better suit the needs of individual policyholders. They provide flexibility and allow policyholders to tailor their coverage to their specific requirements. However, it is crucial to understand the details and implications of policy endorsements to ensure they align with your insurance needs and preferences.

Types of Policy Endorsements

There are various types of policy endorsements available, each serving a specific purpose. Let’s explore some common types of policy endorsements:

1. Coverage Extensions: These endorsements expand the coverage provided by the policy. For example, a homeowner’s insurance policy may have a coverage extension endorsement for water damage to include coverage for damage caused by burst pipes.

2. Exclusions and Limitations: These endorsements restrict or exclude certain types of coverage. For instance, a car insurance policy may have a limitation endorsement that excludes coverage for damage caused by drivers under a certain age.

3. Additional Insured: This endorsement adds another party to the policy, providing coverage for their interests. For example, in a commercial general liability policy, an additional insured endorsement may be added to include a contractor working on a project.

4. Deductible Changes: These endorsements modify the policy’s deductible, either increasing or decreasing the amount that the policyholder is responsible for paying in the event of a claim.

5. Policy Form Changes: These endorsements modify the policy’s terms and conditions, ensuring compliance with new regulations or addressing specific circumstances not covered in the original policy.

How Policy Endorsements Impact Insurance Policies

Policy endorsements can have a significant impact on insurance policies. Understanding their implications is crucial for policyholders to ensure they have the coverage they need. Here are some ways policy endorsements can affect insurance policies:

1. Enhanced Coverage: Policy endorsements can enhance coverage by extending it to include additional risks or circumstances not originally covered.

2. Restricted Coverage: Conversely, policy endorsements can restrict coverage by excluding certain risks or circumstances from the policy’s coverage.

3. Premium Adjustments: Policy endorsements may result in changes to the policy’s premium. Depending on the endorsement, the premium may increase or decrease.

4. Policy Conditions: Endorsements can modify the terms and conditions of the policy, affecting how claims are handled, deductibles, and other policy provisions.

5. Policyholder Obligations: Policy endorsements may introduce new obligations or requirements for the policyholder to maintain coverage. It is essential to understand these obligations to avoid any potential coverage gaps.

In conclusion, policy endorsements play a vital role in insurance policies as they allow for customization and tailoring of coverage to meet specific needs. Understanding the different types of endorsements and their impact on policies is crucial for policyholders to ensure they have adequate coverage. Always consult with your insurance provider to fully understand the endorsements available and how they may affect your policy. With this knowledge, you can make informed decisions about your insurance coverage and protect yourself against unexpected risks.

Key Takeaways

- Policy endorsements are additional provisions that can be added to an insurance policy to modify its coverage.

- Endorsements can include changes to policy limits, adding or excluding coverage for specific items or events, or extending coverage to additional insured parties.

- Understanding policy endorsements is important to ensure you have the right coverage for your needs.

- Always review and discuss policy endorsements with your insurance agent or provider before making any changes or additions.

- Policy endorsements can help tailor your insurance policy to your specific circumstances and provide added protection.

Frequently Asked Questions:

What are policy endorsements?

Policy endorsements are changes or additions made to an existing insurance policy. They are used to modify the terms and conditions of the policy to better suit the policyholder’s needs. These endorsements can be requested by the policyholder or may be required by the insurance company to address specific situations or risks.

Policy endorsements can cover a wide range of modifications, such as adding or removing coverage, changing policy limits, or updating the named insured. It is important for policyholders to understand the implications of endorsements, as they can have a significant impact on the coverage provided by the policy.

How do policy endorsements work?

Policy endorsements are typically initiated by the policyholder, who submits a request to their insurance company outlining the desired changes. The insurance company will then review the request and determine if the requested changes are acceptable.

If the changes are approved, the insurance company will issue a policy endorsement, which is a written document that outlines the modifications made to the policy. This endorsement becomes part of the policy and should be kept with the original policy documents for future reference.

Can policy endorsements increase insurance premiums?

Yes, policy endorsements can result in changes to insurance premiums. The impact on premiums will depend on the nature of the endorsement and the specific circumstances of the policyholder.

For example, if a policy endorsement increases the coverage limits or adds additional coverage, the insurance company may adjust the premium to reflect the increased risk. On the other hand, if a policy endorsement reduces coverage or removes certain risks, the premium may decrease.

What is the difference between a policy endorsement and a policy rider?

A policy endorsement and a policy rider serve similar purposes, which is to modify an existing insurance policy. However, there is a subtle difference between the two.

A policy endorsement is a broad term that encompasses any changes made to a policy, while a policy rider refers specifically to an additional provision or coverage that is attached to the policy. In other words, a policy rider is a type of policy endorsement that adds specific coverage options or benefits to the policy.

Can policy endorsements be removed or reversed?

Yes, in some cases, policy endorsements can be removed or reversed. However, the ability to remove or reverse an endorsement will depend on the specific circumstances and the insurance company’s policies.

If a policyholder wishes to remove or reverse an endorsement, they should contact their insurance company and discuss their request. The insurance company will review the request and determine if it is feasible to make the desired changes. It is important to note that removing or reversing an endorsement may have implications for the coverage provided by the policy, so policyholders should carefully consider the impact before making any changes.

Policy Endorsements!

Final Summary: Understanding the Power of Policy Endorsements

So there you have it, folks! We’ve embarked on a journey through the intricate world of policy endorsements, unraveling their significance and shedding light on how they can enhance your insurance coverage. Throughout this article, we’ve explored the various types of endorsements that exist, from adding additional insured parties to modifying coverage limits and terms.

By now, you should have a solid understanding of how policy endorsements work and why they are essential in tailoring your insurance to fit your unique needs. Remember, these endorsements are like puzzle pieces that can transform your policy into a comprehensive shield against unexpected risks. Whether you’re a business owner looking to expand your coverage or an individual seeking extra protection, policy endorsements can be your secret weapon.

In conclusion, policy endorsements offer a flexible and dynamic approach to insurance coverage. They allow you to fine-tune your policy based on your specific requirements, ensuring that you’re adequately protected in all situations. So, don’t hesitate to reach out to your insurance provider and have a conversation about the endorsement options available to you. Remember, knowledge is power, and with a deep understanding of policy endorsements, you can navigate the complex insurance landscape with confidence.