What Insurance Does A Commercial Tenant Need?

If you’re a commercial tenant, you know that running a business comes with its fair share of risks. From accidents to property damage, unforeseen events can quickly derail your operations. That’s why it’s crucial to have the right insurance coverage in place to protect your business. But with so many options out there, you might be wondering, “What insurance does a commercial tenant need?”

When it comes to safeguarding your business, there are a few key insurance policies that every commercial tenant should consider. First and foremost, you’ll want to have general liability insurance. This coverage protects you in case someone is injured on your premises or if you accidentally damage someone else’s property. It’s a fundamental policy that provides financial protection against lawsuits and medical expenses.

In addition to general liability insurance, you should also consider property insurance. This type of coverage protects your business property, including the building you’re leasing, your equipment, inventory, and furniture. It’s important to note that property insurance typically covers damage caused by fire, theft, vandalism, and certain natural disasters, so you’ll want to review your policy to ensure you have adequate protection.

By having the right insurance coverage in place, you can have peace of mind knowing that your business is protected from unforeseen events. So, whether you’re a small retail store, a restaurant, or an office space, take the time to assess your insurance needs and find the policies that best suit your business. In the next sections, we’ll dive deeper into the

Understanding the Insurance Needs of Commercial Tenants

Commercial tenants, whether they operate a small business or a large corporation, need to consider several important factors when it comes to insurance. Having the right insurance coverage can protect their business, assets, and financial stability in the event of unforeseen circumstances. In this article, we will explore the various types of insurance that commercial tenants should consider to ensure comprehensive coverage.

General Liability Insurance

General liability insurance is one of the most essential types of coverage for commercial tenants. It provides protection against claims of bodily injury, property damage, or personal injury that may occur on the premises. This insurance can cover legal fees, medical expenses, and potential settlements or judgments in case of a lawsuit. It is crucial for commercial tenants to have general liability insurance to protect themselves from potential financial losses resulting from accidents or incidents that may happen on their property.

It’s important to note that general liability insurance does not cover all types of risks. It typically excludes coverage for professional errors, product liability, and employee injuries. Commercial tenants may need additional types of insurance to cover these specific risks.

Property Insurance

Property insurance is another crucial type of coverage for commercial tenants. It protects the physical assets of the business, including the building, equipment, inventory, and furniture, against perils such as fire, theft, vandalism, or natural disasters. This insurance provides financial compensation to repair or replace damaged property, ensuring that businesses can recover and continue their operations.

Commercial tenants should carefully assess the value of their assets and determine the appropriate coverage amount for their property insurance. It’s essential to review the policy and understand what is covered, as some policies may have exclusions or limitations for certain events or types of property.

In addition to general liability and property insurance, commercial tenants may need to consider other types of coverage based on their specific industry and business operations. Let’s explore some additional insurance options that can provide comprehensive protection.

Business Interruption Insurance

Business interruption insurance, also known as business income insurance, is designed to compensate commercial tenants for lost income and ongoing expenses in the event of a covered disruption to their operations. This could include scenarios such as a fire, natural disaster, or other unforeseen events that force the business to temporarily close or suspend operations.

With business interruption insurance, commercial tenants can receive financial assistance to cover ongoing expenses like rent, payroll, utilities, and other fixed costs while they work to get their business back on track. This coverage is crucial as it provides a safety net during challenging times and helps businesses maintain financial stability.

Worker’s Compensation Insurance

Worker’s compensation insurance is a legal requirement in most jurisdictions for businesses that have employees. It provides coverage for medical expenses, lost wages, and rehabilitation costs in case an employee is injured or becomes ill due to work-related activities. Commercial tenants must ensure they have appropriate worker’s compensation insurance to comply with legal obligations and protect their employees.

Worker’s compensation insurance not only provides financial protection for employees but also safeguards commercial tenants from potential lawsuits related to workplace injuries. It is essential to understand the specific regulations and requirements of the jurisdiction in which the business operates to ensure compliance with worker’s compensation laws.

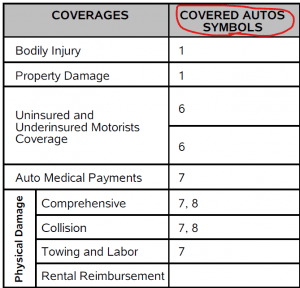

In addition to these primary types of insurance, commercial tenants may need to consider other forms of coverage depending on their industry and specific risks. Some examples include professional liability insurance, product liability insurance, cyber liability insurance, and commercial auto insurance. Working with an experienced insurance broker can help commercial tenants assess their unique needs and find the most suitable coverage options.

Additional Considerations for Commercial Tenants

In addition to insurance coverage, commercial tenants should also consider the following factors when managing their risk:

Regular Risk Assessments

Commercial tenants should conduct regular risk assessments to identify potential hazards and implement appropriate safety measures. This can help prevent accidents and reduce the likelihood of insurance claims, ultimately leading to lower premiums and a safer working environment.

Document Retention

Maintaining proper documentation is crucial for commercial tenants. This includes keeping records of insurance policies, lease agreements, safety protocols, and any incidents that occur on the premises. These documents can be valuable in case of a claim or legal dispute and should be easily accessible when needed.

Reviewing Insurance Policies Annually

Insurance needs can change over time, so it’s important for commercial tenants to review their policies annually. This allows them to reassess their coverage requirements and make any necessary adjustments to ensure they have adequate protection.

Emergency Preparedness

Commercial tenants should have an emergency preparedness plan in place to mitigate potential risks and respond effectively to unexpected events. This includes having evacuation procedures, emergency contact information, and contingency plans for business continuity.

Overall, commercial tenants need to carefully consider their insurance needs to protect their business, assets, and financial stability. General liability and property insurance are essential, but additional coverage options may be necessary based on the specific industry and operations. Conducting regular risk assessments, maintaining proper documentation, reviewing policies annually, and having an emergency preparedness plan are also important steps in managing risk effectively. By taking these measures, commercial tenants can safeguard their business and focus on achieving their goals with peace of mind.

Key Takeaways: What Insurance Does a Commercial Tenant Need?

When renting a commercial space, it’s important for tenants to have the right insurance coverage. Here are the key things to consider:

- General liability insurance protects against bodily injury or property damage caused by the tenant or their employees.

- Property insurance covers the tenant’s belongings and improvements made to the rental space.

- Business interruption insurance provides coverage for lost income if the tenant’s operations are disrupted.

- Workers’ compensation insurance is necessary if the tenant has employees, as it covers medical expenses and lost wages in case of work-related injuries.

- Additional coverage may be needed depending on the nature of the tenant’s business, such as professional liability insurance or product liability insurance.

Frequently Asked Questions

When it comes to renting a commercial property, it’s important for tenants to have the right insurance coverage to protect themselves and their businesses. Here are some commonly asked questions about the insurance needs of commercial tenants.

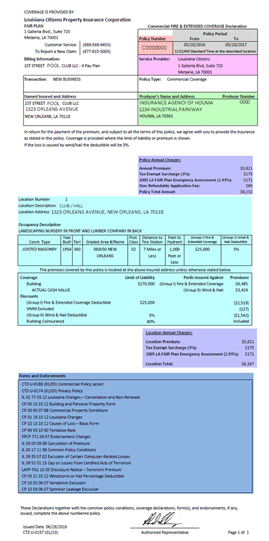

Question 1: What is commercial property insurance?

Commercial property insurance is a type of insurance that provides coverage for the physical assets of a business. This includes the building, equipment, inventory, and other property owned by the business. It helps protect against losses caused by fire, theft, vandalism, and certain natural disasters.

As a commercial tenant, you may not own the building, but you should still consider getting commercial property insurance to protect your own assets. This insurance can cover your business equipment, inventory, and improvements you’ve made to the space.

Question 2: Do I need liability insurance as a commercial tenant?

Yes, liability insurance is essential for commercial tenants. It provides coverage for accidents or injuries that occur on your premises and protects you from potential lawsuits. For example, if a customer slips and falls in your store, liability insurance can help cover their medical expenses and legal fees if they decide to sue.

Liability insurance can also protect you in case you cause damage to the property you’re renting. Accidental fires or water damage caused by your business operations could be covered under liability insurance.

Question 3: What is business interruption insurance?

Business interruption insurance is a type of coverage that helps protect against financial losses when a business is unable to operate due to a covered event, such as a fire or natural disaster. It can help cover lost income, ongoing expenses, and even the cost of temporarily relocating your business.

As a commercial tenant, it’s important to consider business interruption insurance, especially if your business relies heavily on the physical location and would suffer significant financial losses if you had to temporarily close your doors.

Question 4: Should I consider tenant improvement insurance?

Tenant improvement insurance, also known as betterments and improvements coverage, is designed to protect the improvements you’ve made to the rental space. This can include things like renovations, fixtures, or added structures.

If you’ve invested time and money into improving the space you’re renting, tenant improvement insurance can help protect your investment. It can cover damages to the improvements caused by covered events, such as fire or water damage.

Question 5: Can I rely on the landlord’s insurance?

While the landlord’s insurance may cover the building itself, it typically does not provide coverage for the tenant’s property or liability. It’s important to have your own insurance as a commercial tenant to ensure you are adequately protected.

Relying solely on the landlord’s insurance could leave you exposed to financial risks and potential lawsuits. It’s best to discuss your insurance needs with an insurance professional who can help you determine the appropriate coverage for your specific business.

Final Thoughts

When it comes to insurance for commercial tenants, there are a few key policies to consider. While the specific coverage needed may vary depending on the nature of the business and the lease agreement, there are a few common insurance types that every commercial tenant should have in place.

First and foremost, commercial liability insurance is essential. This coverage protects tenants in the event of accidents or injuries that occur on the premises. Whether it’s a slip and fall or property damage caused by the tenant’s operations, liability insurance provides financial protection and peace of mind.

In addition to liability insurance, property insurance is a must. This policy covers the physical assets of the business, including the building, equipment, and inventory. It safeguards against damage or loss due to fire, theft, vandalism, and other covered perils.

Depending on the business, additional coverage such as business interruption insurance or professional liability insurance may also be necessary. These policies help protect against income loss and legal claims, respectively.

Remember, each commercial tenant’s insurance needs may be unique, so it’s always best to consult with an insurance professional to determine the most appropriate coverage for your specific situation. By having the right insurance policies in place, commercial tenants can protect their business, their assets, and their financial stability.