Does Commercial General Liability Insurance Cover Automobile Liability?

When it comes to commercial general liability insurance, many business owners may wonder if it covers automobile liability as well. The answer to this question is important because it can have significant implications for businesses that rely on vehicles for their operations. Without the proper coverage, an accident involving a company vehicle could lead to expensive lawsuits and financial burdens.

Commercial general liability insurance typically does not cover automobile liability. This is because automobile liability falls under a separate type of insurance called commercial auto insurance. Commercial auto insurance is specifically designed to protect businesses against liability and property damage caused by their vehicles. It is important for businesses to obtain both commercial general liability insurance and commercial auto insurance to ensure comprehensive protection in case of accidents or damages.

Commercial General Liability Insurance provides coverage for third-party bodily injury or property damage claims arising from your business operations, but it typically does not cover automobile liability. To protect against automobile-related risks, you should consider purchasing Commercial Auto Insurance. This specialized policy offers coverage for accidents, collisions, and other vehicle-related incidents. It’s important to consult with an insurance professional or broker to determine the coverage that best suits your specific business needs.

Understanding the Coverage of Commercial General Liability Insurance for Automobile Liability

Commercial General Liability (CGL) insurance is a type of insurance that provides coverage for a business’s liability arising from accidents, injuries, or property damage that occur on their premises or are caused by their operations. However, when it comes to automobile liability, the coverage provided by CGL insurance may be limited. It is essential for businesses to understand the scope of their policy and consider obtaining additional insurance specifically for automobile liability to ensure they are adequately protected.

Coverage for Owned Vehicles

CGL insurance typically does not provide coverage for owned vehicles used in business operations. If your business owns vehicles and uses them for activities such as transporting goods or employees, you will need a separate commercial auto insurance policy to cover the liability associated with those vehicles. Commercial auto insurance provides coverage for physical damage to owned vehicles as well as liability coverage for bodily injury or property damage caused by those vehicles.

The main reason why CGL insurance does not cover owned vehicles is the existence of specific auto insurance policies tailored to cover automobile liability. These policies take into account the unique risks associated with operating vehicles and offer comprehensive protection that aligns with the specific needs of businesses that own and use vehicles in their operations.

It is important to note that even if you have commercial auto insurance, it may have limitations on coverage. For example, certain types of vehicles or activities may be excluded, or there may be specific limits to the amount of coverage provided. It is crucial to carefully review your commercial auto insurance policy and consider any additional coverage options that may be necessary to adequately protect your business.

Coverage for Non-Owned or Hired Vehicles

In some cases, a business may not own any vehicles but may still utilize non-owned or hired vehicles for their operations, such as when renting a vehicle for a specific project or using an employee’s personal vehicle for business purposes. While CGL insurance may provide some limited coverage for non-owned or hired vehicles, it is typically advisable to obtain specific coverage through a hired/non-owned auto liability insurance policy to ensure adequate protection.

Hired/non-owned auto liability insurance provides coverage for bodily injury or property damage caused by vehicles that are not owned by the business but are used in its operations. This type of coverage can help protect the business from potential lawsuits or claims arising from accidents involving non-owned or hired vehicles.

It is essential for businesses to carefully assess their needs and consult with an insurance professional to determine the appropriate coverage for non-owned or hired vehicles. This will help ensure that any potential gaps in coverage are addressed and that the business is fully protected in the event of an accident or injury involving a non-owned or hired vehicle.

Exclusions and Limitations

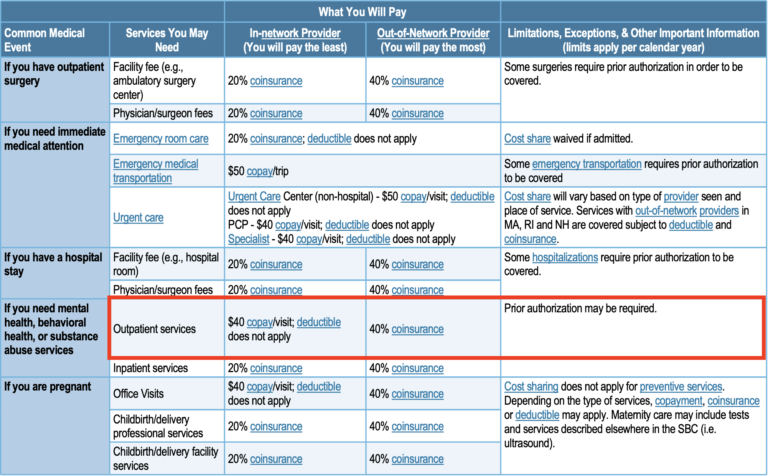

While commercial auto insurance is the primary policy for covering automobile liability for owned or non-owned vehicles, it is important to understand that there may still be exclusions and limitations within these policies. These exclusions and limitations can vary depending on the insurance provider and the specific policy.

Common exclusions in commercial auto insurance policies may include:

- Intentional acts or criminal activities

- Racing or other high-risk activities

- Vehicles used for livery or public transportation

- Vehicles used for construction or other specialized purposes

- Unlicensed or uninsured drivers

Additionally, there may be limitations on coverage amounts, deductibles, and specific terms and conditions that businesses need to be aware of. It is crucial to thoroughly review the terms of the commercial auto insurance policy and consult with an insurance professional to fully understand the coverage and any potential limitations or exclusions.

Supplementing CGL Insurance for Automobile Liability

Given the limitations of CGL insurance regarding automobile liability, it is recommended that businesses consider supplementing this coverage with additional insurance policies tailored specifically for vehicle-related risks. This can help ensure comprehensive protection and mitigate any potential gaps in coverage.

Some of the supplementary insurance options that businesses may consider include:

- Commercial auto insurance: This provides coverage for owned vehicles and can also include coverage for non-owned or hired vehicles.

- Hired/non-owned auto liability insurance: This covers liability for accidents involving non-owned or hired vehicles.

- Umbrella liability insurance: This provides additional liability coverage beyond the limits of primary policies, including commercial auto insurance.

- Specialized insurance: Depending on the nature of the business and the specific risks involved, additional specialized insurance policies may be necessary to provide coverage for unique situations or vehicles, such as those used for commercial transportation or construction purposes.

By carefully selecting and combining these various insurance policies, businesses can create a comprehensive risk management strategy that addresses their specific needs and provides adequate coverage for automobile liability.

Understanding the coverage provided by commercial general liability insurance for automobile liability is crucial for businesses. While CGL insurance may provide coverage for accidents, injuries, or property damage that occur on business premises or are caused by operations, it typically does not cover owned vehicles or provide comprehensive coverage for non-owned or hired vehicles. Businesses should carefully assess their needs, review their commercial auto insurance policy, and consider supplementing their coverage with additional policies tailored specifically for automobile liability to ensure they are adequately protected. By doing so, businesses can mitigate potential risks and protect their financial interests in the event of an accident or injury involving vehicles used in their operations.

Coverage of Commercial General Liability Insurance for Automobile Liability

Commercial General Liability (CGL) insurance provides coverage for a range of business-related liabilities, but it typically does not cover automobile liability. CGL insurance policies are designed to protect businesses against claims of bodily injury or property damage caused by their operations or products. However, when it comes to automobiles, companies typically need separate auto liability insurance.

While CGL policies may include limited coverage for liability arising from the use of non-owned vehicles, it is crucial for businesses to have specific auto liability insurance to adequately protect themselves. Auto liability insurance covers bodily injury and property damage caused by company-owned or leased vehicles.

Having separate auto liability insurance ensures that businesses are adequately protected in case of accidents, third-party claims, or lawsuits involving company vehicles. It is important for businesses to consult with an insurance professional to determine the appropriate coverage needed based on their specific operations and risks.

Key Takeaways

- Commercial General Liability (CGL) insurance does not typically cover automobile liability.

- It is important for businesses to have separate auto insurance coverage to protect against liability for vehicles.

- Commercial auto insurance provides coverage for bodily injury and property damage caused by vehicles used for business purposes.

- Businesses should consider purchasing commercial auto insurance to ensure comprehensive coverage.

- Consulting with an insurance professional can help businesses determine the right insurance coverage for their specific needs.

Frequently Asked Questions

Here are some frequently asked questions about whether commercial general liability insurance covers automobile liability.

1. Does commercial general liability insurance cover automobile accidents?

No, commercial general liability insurance typically does not cover automobile accidents. Commercial general liability insurance is designed to protect businesses from third-party claims for bodily injury or property damage that occur on their premises or as a result of their operations. Automobile accidents are usually covered by separate commercial auto insurance policies.

It’s important for businesses with commercial vehicles to have adequate commercial auto insurance coverage to protect against liability arising from accidents involving company-owned vehicles or vehicles used for business purposes.

2. What is covered by commercial auto insurance?

Commercial auto insurance covers liability for bodily injury and property damage caused by vehicles used for business purposes. It also covers medical expenses for injuries sustained by the driver and passengers in the company vehicles, as well as damage to the vehicles themselves. Additionally, commercial auto insurance can provide coverage for theft, vandalism, and other non-accident-related damage to the vehicles.

Commercial auto insurance is essential for businesses that own, lease, or use vehicles for their operations. It helps protect against the financial consequences of accidents and other unforeseen events involving company vehicles.

3. Can I add automobile liability coverage to my commercial general liability policy?

Some insurance companies offer endorsements or riders that allow businesses to add automobile liability coverage to their commercial general liability policies. These endorsements can provide coverage for liability arising from the use of non-owned or hired vehicles in the course of business operations. However, it’s important to review the terms and conditions of the endorsement to ensure that it offers adequate protection for your specific needs.

If your business relies heavily on the use of vehicles, it’s usually recommended to have a separate commercial auto insurance policy to ensure comprehensive coverage for automobile liability.

4. Is commercial auto insurance required by law?

In most states, businesses that own or use vehicles for commercial purposes are required by law to carry commercial auto insurance. The specific coverage requirements vary by state, but typically include liability insurance to cover bodily injury and property damage caused by the vehicles.

It’s important to check the legal requirements in your state and ensure that your business has the appropriate commercial auto insurance coverage to comply with the law and protect your business from potential liability claims.

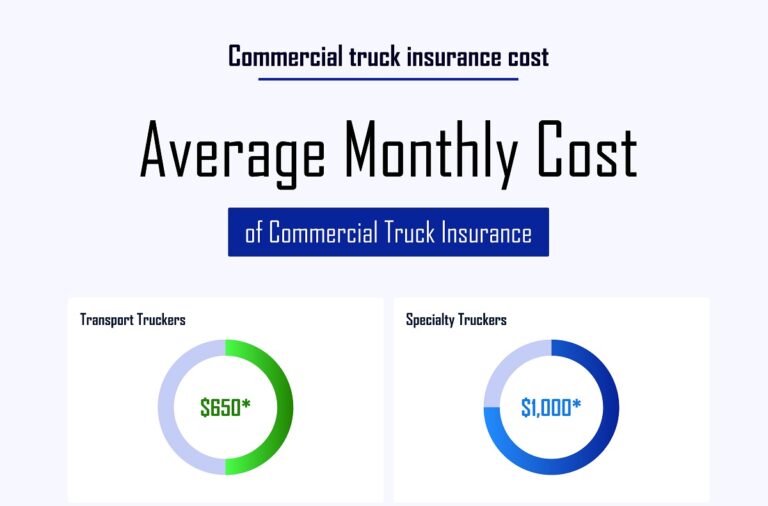

5. How much does commercial auto insurance cost?

The cost of commercial auto insurance varies depending on factors such as the type of vehicles, their usage, the coverage limits, the driving history of the drivers, and the location of the business. Generally, larger vehicles and those used for specialized purposes, such as delivery trucks or construction vehicles, tend to have higher insurance premiums.

To determine the exact cost of commercial auto insurance for your business, it’s best to obtain quotes from multiple insurance providers and compare their coverage options and premiums. Working with an insurance broker who specializes in commercial insurance can also help you find the best coverage at a competitive price.

General Liability Insurance Explained in 10 Minutes

Commercial General Liability (CGL) insurance typically does not cover automobile liability. CGL insurance is designed to protect businesses from liability claims arising from their operations, premises, or products. While it provides coverage for bodily injury or property damage caused by accidents on business property, it does not extend to automobile accidents.

To cover automobile liability, businesses need a separate insurance policy known as commercial auto insurance. This type of insurance provides coverage for bodily injury, property damage, or medical expenses resulting from accidents involving vehicles used for business purposes. It is important for businesses to have both CGL insurance and commercial auto insurance to ensure comprehensive coverage and protection.