Does Business Interruption Cover Wages?

Are you wondering if business interruption insurance covers wages? Well, you’ve come to the right place! In this article, we’ll dive into the details of business interruption coverage and whether it includes wages for your employees.

Picture this: you’re a business owner, and unfortunately, disaster strikes. Your business is forced to temporarily close its doors, and you’re left wondering how you’ll manage to pay your employees during this difficult time. This is where business interruption insurance comes into play.

Business interruption insurance is designed to provide financial protection in the event that your business is unable to operate due to covered perils, such as fire, natural disasters, or even a global pandemic. It helps cover the costs of ongoing expenses, like rent and utilities, as well as lost profits. But does it also cover wages?

Join us as we explore this question in detail and uncover the ins and outs of business interruption coverage when it comes to your employees’ wages. So grab a cup of coffee, sit back, and let’s dive in!

Does Business Interruption Cover Wages?

Business interruption insurance is designed to provide coverage for income loss and additional expenses that a business may incur due to a covered event, such as a fire, natural disaster, or other unforeseen circumstances. However, when it comes to covering wages, the answer can vary depending on the specific policy and the circumstances surrounding the interruption. In this article, we will explore the topic of whether business interruption insurance covers wages and provide insights to help you understand the coverage options available.

The Basics of Business Interruption Insurance

Business interruption insurance is typically included as part of a comprehensive commercial property insurance policy. It is designed to protect businesses from the financial impact of disruptions that can result in lost income and increased expenses. When a covered event occurs, such as a fire that damages a building, business interruption insurance can help compensate for the income loss that occurs while the business is unable to operate.

The coverage typically extends beyond just lost revenue. It can also help cover fixed expenses, such as rent and utilities, as well as additional expenses that may be necessary to minimize the interruption and resume operations. However, the specific coverage and limits will vary depending on the policy and the insurer.

Does Business Interruption Insurance Cover Wages?

One of the key questions that many business owners have is whether business interruption insurance covers wages. Unfortunately, there is no simple answer to this question. The coverage for wages will depend on the specific policy wording and the circumstances surrounding the interruption.

In some cases, business interruption insurance may cover wages. If the policy includes a provision for “payroll coverage” or “employee wages,” then wages may be eligible for reimbursement. However, it’s important to note that there may be limitations and exclusions depending on the policy wording.

Policy Provisions for Wages

Some business interruption policies specifically include coverage for employee wages as part of the overall coverage. This means that if a covered event occurs and the business is unable to operate, the policy may provide reimbursement for a portion of the wages paid to employees during the interruption period.

However, it’s crucial to carefully review the policy language to understand the specific terms and conditions of the coverage. There may be limitations on the amount of coverage provided for wages, such as a maximum percentage or a specific time period. It’s also important to consider whether the coverage applies to all employees or only certain categories, such as full-time employees.

Exclusions and Limitations

While some policies may include coverage for wages, others may have exclusions or limitations that restrict the reimbursement of wages. For example, a policy may exclude coverage for wages if the interruption is caused by a specific event, such as a pandemic or government order. It’s essential to carefully review the policy terms to understand any exclusions or limitations that may apply.

Additionally, even if the policy includes coverage for wages, there may be limitations on the duration of the coverage. For example, the policy may only provide reimbursement for a certain number of weeks or months. It’s important to understand the time limits associated with the coverage and how they align with your business needs.

Understanding the Coverage Options

To ensure that your business is adequately protected, it’s essential to review your insurance policy and understand the specific coverage options available. Here are some considerations to keep in mind:

Review Your Policy

Take the time to thoroughly review your business interruption insurance policy. Look for any provisions related to wages or employee compensation. Pay close attention to any exclusions or limitations that may impact the coverage for wages.

Consider Additional Coverage

If your current policy does not provide sufficient coverage for wages, consider purchasing additional coverage. Speak with your insurance provider to explore your options and understand the cost implications.

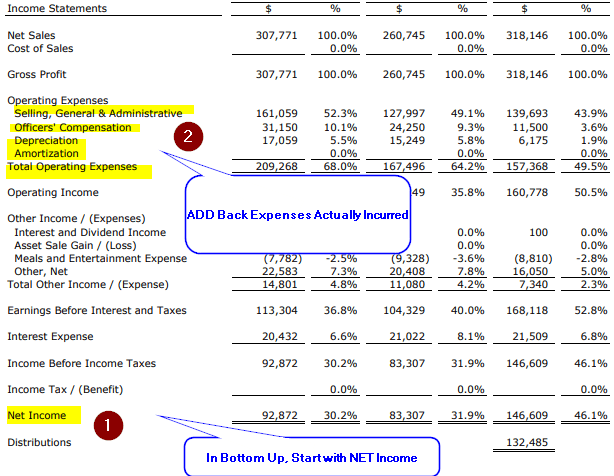

Document Your Expenses

In the event of an interruption, it’s crucial to document all expenses related to employee wages. Keep detailed records of the wages paid during the interruption period, as well as any additional expenses incurred to minimize the impact of the interruption.

Consult with an Insurance Professional

If you have questions or concerns about your business interruption coverage, it’s advisable to consult with an insurance professional. They can provide guidance based on your specific circumstances and help you navigate the complexities of your policy.

In conclusion, the coverage for wages under business interruption insurance can vary depending on the specific policy and the circumstances of the interruption. While some policies may include provisions for wages, others may have exclusions or limitations. It’s essential to thoroughly review your policy and consult with an insurance professional to ensure that your business is adequately protected. By understanding your coverage options and taking proactive steps, you can mitigate the financial impact of an interruption and help your business recover more quickly.

Key Takeaways: Does Business Interruption Cover Wages?

- Business interruption insurance typically covers lost revenue and certain expenses during a period of business interruption.

- However, coverage for employee wages may vary depending on the policy and the specific circumstances surrounding the interruption.

- Some policies may include coverage for wages, while others may require additional endorsements or separate coverage.

- It is important for business owners to review their insurance policies carefully to understand what is covered and what is not.

- Consulting with an insurance professional can help clarify any questions and ensure appropriate coverage is in place.

Frequently Asked Questions

Does business interruption cover wages?

When it comes to business interruption insurance, the coverage can vary depending on the specific policy and insurer. In general, business interruption insurance is designed to cover the financial losses a business may face as a result of an interruption in its operations. This can include things like lost revenue, extra expenses, and even some types of payroll costs. However, whether or not wages are covered under business interruption insurance can depend on several factors.

Firstly, it is important to review the terms and conditions of your specific policy. Some policies may explicitly state that wages are covered, while others may not. Additionally, the circumstances surrounding the interruption can also play a role. For example, if the interruption is caused by a covered event such as a natural disaster or fire, the policy may include provisions for covering wages. However, if the interruption is due to other causes, such as a labor strike or a government shutdown, the coverage for wages may be limited or excluded.

What types of payroll costs are typically covered?

While each policy is different, there are generally certain types of payroll costs that may be covered under business interruption insurance. These can include regular wages, salaries, and even certain benefits and bonuses that are directly tied to an employee’s compensation. Additionally, some policies may also cover the costs of hiring temporary employees or outsourcing work to help keep the business running during the interruption.

However, it’s important to note that there are often limitations and exclusions when it comes to payroll coverage. For example, the policy may only cover a certain percentage of payroll costs or may have a maximum limit on the amount that can be claimed. It’s also important to keep in mind that business interruption insurance is typically designed to cover the actual loss of income and expenses, rather than providing full reimbursement for all payroll costs.

Are there any specific requirements for claiming wages under business interruption insurance?

When it comes to claiming wages under business interruption insurance, there may be certain requirements that need to be met. These requirements can vary depending on the specific policy and insurer. Some common requirements may include providing documentation of the wages paid, such as payroll records or tax documents, as well as demonstrating that the wages are directly tied to the interruption in business operations.

It’s also important to note that there may be specific time limits for filing a claim for wages under business interruption insurance. It’s recommended to review the terms and conditions of your policy and consult with your insurance provider to understand the specific requirements and deadlines for claiming wages.

What are some common exclusions when it comes to wages under business interruption insurance?

While business interruption insurance can provide valuable coverage for businesses facing interruptions in their operations, there are often exclusions when it comes to wages. Some common exclusions may include wages that are not directly tied to the interruption, such as bonuses or overtime pay that would have been paid regardless of the interruption. Additionally, wages for employees who are not essential to the core operations of the business may also be excluded.

It’s important to carefully review the terms and conditions of your policy to understand any specific exclusions when it comes to wages. Consulting with your insurance provider can also help clarify any questions or concerns you may have regarding the coverage of wages under your business interruption insurance.

What other types of financial losses can business interruption insurance cover?

Business interruption insurance is designed to cover a range of financial losses that a business may incur as a result of an interruption in its operations. In addition to wages, some other types of financial losses that may be covered include lost revenue, extra expenses incurred to minimize the impact of the interruption, and even certain fixed costs such as rent or mortgage payments. The coverage will depend on the specific terms and conditions of your policy, so it’s important to review it carefully to understand what is covered and what is not.

It’s also worth noting that business interruption insurance can also provide coverage for the period of time it takes for a business to resume normal operations after the interruption. This can include coverage for the costs of relocating to a temporary location, as well as any additional expenses incurred during the recovery process.

Final Thought

So, does business interruption insurance cover wages? The short answer is, it depends. While business interruption insurance is designed to help cover the financial losses incurred during a period of interruption, such as a natural disaster or other unforeseen event, the coverage for employee wages can vary from policy to policy.

Some business interruption policies may include coverage for wages as part of their standard offering, while others may require an additional endorsement or rider to be added. It’s important for business owners to carefully review their policy and discuss their specific needs with their insurance provider to ensure they have the appropriate coverage in place.

In conclusion, business interruption insurance can provide financial protection for businesses during times of interruption, but the coverage for wages may not be automatic. It’s crucial for business owners to thoroughly understand their policy and work closely with their insurance provider to tailor coverage to their unique needs. By doing so, they can help safeguard their business and ensure that their employees are taken care of in times of uncertainty.