When Is Medicare Secondary To Commercial Insurance?

When is Medicare secondary to commercial insurance? It’s a common question that arises when individuals have both Medicare and private health insurance. The answer depends on several factors, including the size of the employer providing the commercial insurance and the type of coverage it offers. Understanding the rules and guidelines around Medicare as a secondary payer can help individuals navigate the complex world of healthcare coverage.

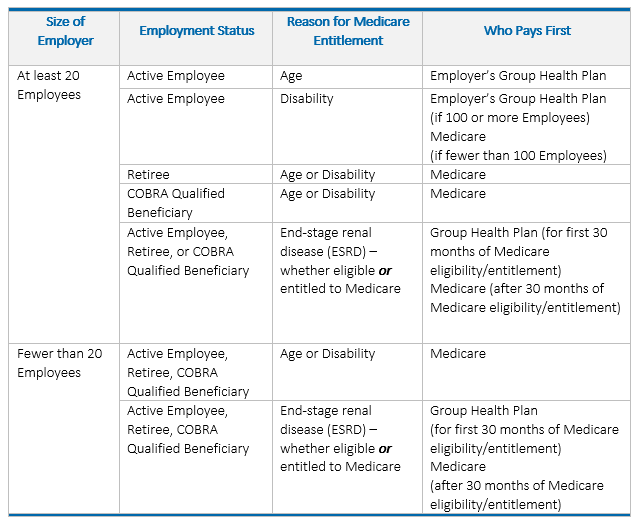

Medicare secondary to commercial insurance typically occurs in situations where an individual has employer-sponsored health insurance through an organization with 20 or more employees. In these cases, the employer’s insurance coverage will be the primary payer, while Medicare serves as the secondary payer. This arrangement helps ensure that medical expenses are covered adequately, with the employer-sponsored insurance bearing the majority of the costs. It’s important to note that Medicare serves as the primary payer for individuals with employer-sponsored coverage from organizations with less than 20 employees or for those who are self-employed and have Medicare as their primary insurance.

Medicare is secondary to commercial insurance when an individual has both Medicare and a private insurance plan. Commercial insurance becomes the primary payer, covering costs first, while Medicare acts as the secondary payer, covering costs that aren’t covered by the primary insurance plan. This typically occurs when an individual is aged 65 or older and still working, or when they have a disability and have private insurance through their employer or union. Understanding the coordination of benefits rules is crucial to ensuring proper coverage and minimizing out-of-pocket expenses.

Understanding the Coordination of Benefits

When it comes to healthcare coverage, navigating the complexities of Medicare and commercial insurance can be challenging. One important aspect to understand is the coordination of benefits, specifically when Medicare is secondary to commercial insurance. This occurs when a person has both Medicare and another type of health insurance. In these cases, Medicare serves as the secondary payer, meaning it pays for healthcare costs after the primary insurance has paid its share.

Eligibility Criteria for Medicare Secondary Payer (MSP)

To determine when Medicare is secondary to commercial insurance, certain criteria must be met. The primary insurance, which is typically the individual’s commercial insurance, must meet the following conditions:

- The individual has coverage through an employer or union group health plan based on current employment

- The individual has coverage through a group health plan where the employer or union is 20 or more employees

- The individual has coverage through a group health plan where the employer or union is less than 20 employees

- The individual has coverage through a group health plan that is the result of a Consolidated Omnibus Budget Reconciliation Act (COBRA) policy or continuation coverage based on a previous employment

- The individual has coverage through certain types of Veterans Affairs (VA) plans

If any of the above criteria are met, Medicare will take on the secondary payer role, and the individual’s commercial insurance will become the primary payer for their healthcare expenses.

It’s important to note that if the individual’s employer or union-sponsored group health plan has fewer than 20 employees, Medicare will usually serve as the primary payer regardless of other insurance coverage. However, in cases where the individual has coverage through COBRA or based on certain VA plans, Medicare will still be the secondary payer.

The Order of Payment for Healthcare Expenses

When determining the order of payment for healthcare expenses, Medicare follows a specific hierarchy:

- Step 1: Primary payer pays its share. The primary insurance, which is typically the individual’s commercial insurance, pays the portion of the healthcare expenses that it covers according to its plan.

- Step 2: Medicare pays its share. Medicare pays the remaining eligible healthcare expenses that the primary payer did not cover.

- Step 3: The individual is responsible for the remaining cost. If there are any healthcare expenses left after the primary insurance and Medicare have paid their shares, the individual must pay for those out-of-pocket.

It’s important for individuals with both Medicare and commercial insurance to understand this payment order and how it may impact their out-of-pocket expenses.

However, there are specific situations where Medicare may be the primary payer instead of the secondary payer, such as when the individual has end-stage renal disease (ESRD) and is in the first 30 months of Medicare eligibility.

Understanding the coordination of benefits and the order of payment for healthcare expenses can help individuals make informed decisions about their coverage and minimize their healthcare costs.

How to Coordinate Benefits Effectively

Effectively coordinating benefits between Medicare and commercial insurance involves taking the following steps:

- Inform healthcare providers. It’s important to inform healthcare providers that you have both Medicare and commercial insurance to ensure that claims are submitted correctly.

- Provide accurate information. When filling out health insurance forms, provide accurate and up-to-date information about your Medicare and commercial insurance coverage.

- Keep records. Keep copies of all health insurance claims, explanations of benefits, and other relevant documents to track your healthcare expenses and ensure proper coordination of benefits.

- Contact the benefits coordinator. If you have any questions or concerns about the coordination of benefits, contact the benefits coordinator of your primary insurance or Medicare.

By following these steps, individuals can help ensure a smooth process in coordinating benefits between Medicare and commercial insurance, reducing the risk of claim denials or payment delays.

Additional Considerations

It’s essential to consider the following additional factors when determining when Medicare is secondary to commercial insurance:

1. Health plan-specific rules: Each health plan may have its own rules and guidelines for coordination of benefits. It’s important to familiarize yourself with the specifics of your commercial insurance policy to understand when Medicare will serve as the secondary payer.

2. Medicare Advantage Plans: If you have a Medicare Advantage Plan, the coordination of benefits rules may be different. It’s crucial to review your plan documents and contact your plan provider for information on how coordination of benefits works in your specific situation.

3. Claims processing timeline: Claims processing times can vary between Medicare and commercial insurance. It’s important to be aware of these timelines to understand when to expect reimbursement or payment for healthcare expenses.

Conclusion

Coordinating benefits between Medicare and commercial insurance requires understanding the eligibility criteria, payment order, and taking proactive steps. By being informed and following the necessary actions, individuals can streamline the process and effectively manage their healthcare expenses. It’s crucial to stay updated on any changes to Medicare and commercial insurance guidelines to ensure continued coordination of benefits.

When Is Medicare Secondary To Commercial Insurance?

Medicare and commercial insurance are two different types of health insurance coverage. Medicare is a federal health insurance program provided for individuals who are 65 years and older, or for individuals under 65 with certain disabilities. Commercial insurance, on the other hand, refers to health insurance plans provided by private insurance companies.

Medicare is typically considered the primary payer for healthcare services. However, there are certain situations when Medicare can be secondary to commercial insurance:

- If an individual is covered by both Medicare and commercial insurance, the commercial insurance is generally the primary payer. Medicare will be secondary and cover costs that are not covered by the commercial insurance.

- If an individual is still working and has employer-sponsored health insurance, Medicare can be secondary to the commercial insurance provided by their employer.

- In some cases, Medicare may be secondary to commercial insurance for individuals who have certain disabilities and are covered by both types of insurance.

It is important for individuals to understand the coordination of benefits between Medicare and commercial insurance to ensure they receive proper coverage and avoid any billing issues. Consulting with a healthcare professional or insurance specialist can help clarify the specific circumstances in which Medicare would be secondary to commercial insurance.

Key Takeaways

- Medicare becomes secondary to commercial insurance when an individual has both types of coverage.

- If commercial insurance is the primary payer, it will pay first and then Medicare will cover the remaining costs.

- Medicare typically becomes secondary if the individual is still considered actively employed.

- Medicare is secondary to commercial insurance for individuals who have a disability and are covered by a group health plan.

- It is important to coordinate benefits between Medicare and commercial insurance to avoid overpayment or uncovered costs.

Frequently Asked Questions

Medicare is a government-funded health insurance program for individuals who are 65 years of age or older, as well as certain individuals with disabilities. Commercial insurance, on the other hand, refers to private health insurance plans offered by companies. In some cases, Medicare may be secondary to commercial insurance, meaning that commercial insurance will be the primary payer for healthcare expenses. In this FAQ section, we will address common questions related to when Medicare is secondary to commercial insurance.1. Can Medicare be secondary to commercial insurance?

Yes, Medicare can be secondary to commercial insurance in specific situations. When you have commercial insurance and you are eligible for Medicare, commercial insurance will typically be the primary payer for your healthcare expenses. Medicare may then act as the secondary payer, covering some costs that are not covered by your commercial insurance.

It is important to note that commercial insurance may have certain requirements or restrictions that you need to meet before Medicare can become secondary. These requirements may include a specific deductible or out-of-pocket spending limit that you need to meet before Medicare will step in as the secondary payer.

2. When does Medicare become secondary to commercial insurance?

Medicare becomes secondary to commercial insurance when you have both types of coverage and you meet the requirements set by your commercial insurance plan. These requirements may vary depending on the terms and conditions of your commercial insurance policy.

In general, Medicare becomes secondary to commercial insurance when your commercial insurance plan pays its portion of the allowed amount for covered healthcare services. Once your commercial insurance plan has paid its share, Medicare may step in to cover the remaining expenses, if any.

3. What expenses does Medicare cover when it is secondary to commercial insurance?

When Medicare is secondary to commercial insurance, it may cover certain expenses that are not covered by your commercial insurance plan. These expenses may include deductible amounts, co-payments, or coinsurance that are not covered by your commercial insurance.

However, it is essential to review the terms and conditions of your commercial insurance plan to understand what expenses are covered and what portion of the expenses Medicare may cover as the secondary payer.

4. Can Medicare be primary if I have commercial insurance?

In most cases, Medicare will be the primary payer if you have commercial insurance and are eligible for Medicare. However, there are certain situations where commercial insurance may be the primary payer. These situations may include:

– If you are still working and have employer-sponsored group health coverage, your commercial insurance provided by your employer may be primary, and Medicare may be secondary.

– If you have retiree health coverage, your commercial insurance provided by your former employer may be primary, and Medicare may be secondary.

– If you have coverage through a workers’ compensation or no-fault insurance plan, commercial insurance may be the primary payer for injury-related healthcare expenses.

5. How can I determine if Medicare is secondary to my commercial insurance?

To determine if Medicare is secondary to your commercial insurance, it is crucial to review the terms and conditions of your commercial insurance plan. This information can usually be found in your insurance policy documents or by contacting your commercial insurance provider directly.

You can also contact Medicare directly or visit their official website to gain more information about the circumstances under which Medicare may become secondary to commercial insurance.

Is Medicare Primary or Secondary?

In conclusion, Medicare is considered secondary to commercial insurance in certain situations. This typically occurs when an individual has both Medicare and employer-sponsored or private insurance coverage. Medicare will generally only pay for medical expenses after the primary commercial insurance has paid its share.

However, there are some exceptions to this rule. In cases where the individual has employer-sponsored coverage from a small employer with less than 20 employees, Medicare may be primary. It is also worth noting that commercial insurance plans may have different rules regarding coordination of benefits with Medicare, so it is essential to review the specific terms and conditions of each insurance policy.