Is Commercial Auto Insurance More Expensive?

Are you wondering if commercial auto insurance comes with a higher price tag? Well, buckle up and get ready for some valuable insights! When it comes to insuring your business vehicles, cost is always a key consideration. In this article, we’ll explore the factors that impact the cost of commercial auto insurance and answer the burning question: is it more expensive?

Now, before we hit the road, let’s address the elephant in the room. Yes, commercial auto insurance can be pricier than your personal auto insurance. But fear not, my friend, because there’s more to this story than meets the eye. So, fasten your seatbelt and join me as we navigate through the twists and turns of commercial auto insurance costs. Strap in, folks, we’re about to embark on an informative journey!

Understanding Commercial Auto Insurance Costs

Commercial auto insurance is an essential investment for businesses that rely on vehicles to conduct their operations. Whether you own a fleet of delivery trucks or have a single company car, protecting your assets and employees is crucial. However, one common question that arises when considering commercial auto insurance is whether it is more expensive compared to personal auto insurance. In this article, we will explore the factors that contribute to the cost of commercial auto insurance and help you understand why it may be pricier than personal coverage.

Factors Affecting Commercial Auto Insurance Costs

When it comes to determining the cost of commercial auto insurance, several key factors come into play. Understanding these factors will give you a clearer picture of why commercial coverage tends to be more expensive. Let’s take a closer look at each of these factors:

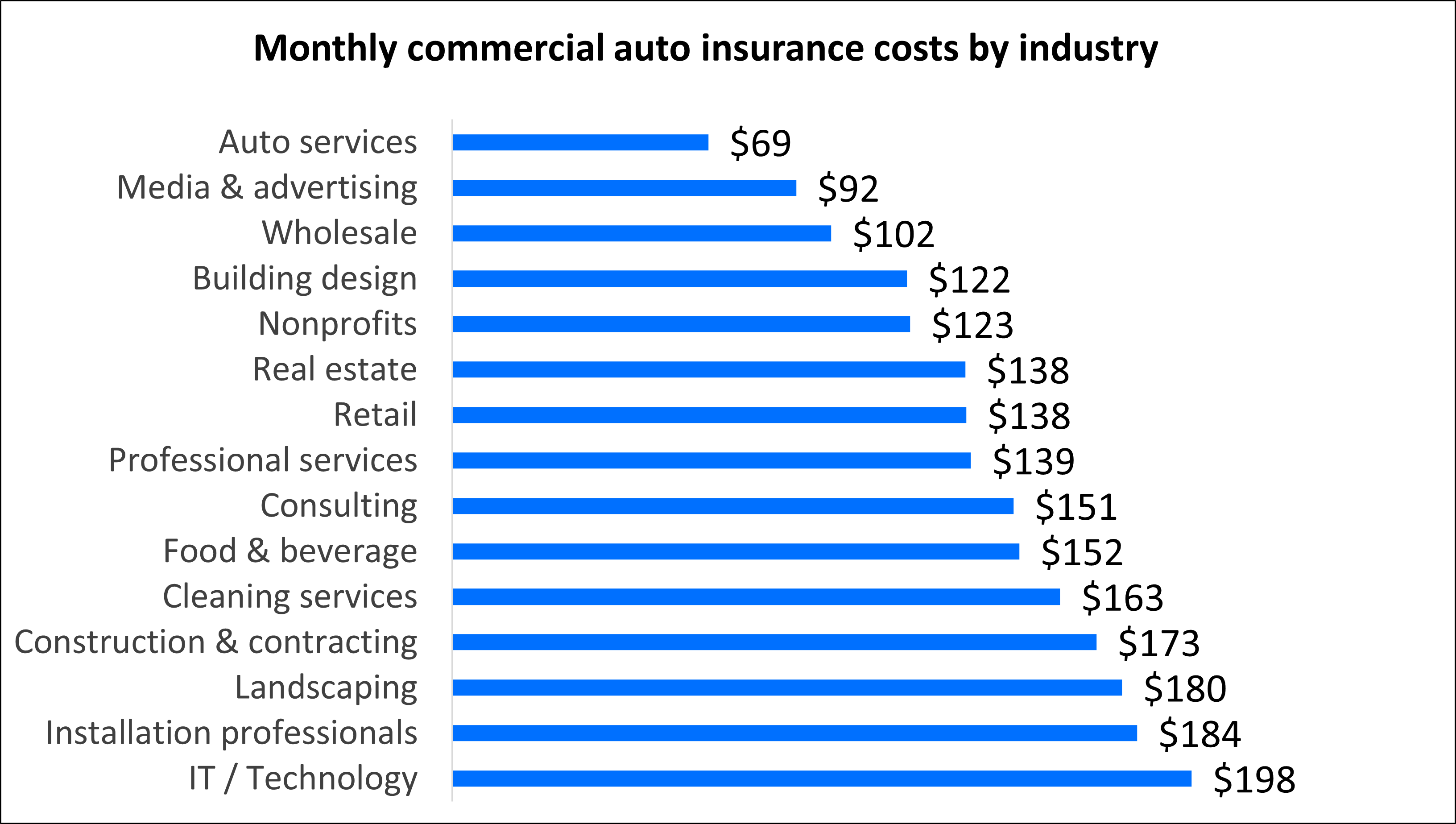

The nature of the business: The type of business you operate plays a significant role in determining the cost of commercial auto insurance. Industries that involve higher risks, such as transportation, construction, or delivery services, typically have higher premiums due to the increased probability of accidents or damage.

Vehicle types and usage: The vehicles you use for your business and how they are utilized can impact insurance costs. Factors such as the size, weight, and value of the vehicles, as well as the distance they travel and the goods they transport, can all influence the premium. For example, a company that uses heavy-duty trucks to transport hazardous materials will likely pay more for insurance compared to a business that operates small passenger vans for client meetings.

Driving record and experience:

The driving records and experience of your employees who will be operating the vehicles also play a significant role in determining insurance costs. Insurance companies consider factors such as past accidents, traffic violations, and years of experience when assessing the risk associated with insuring your business. If your employees have a history of accidents or violations, it may result in higher premiums.

Location and coverage limits:

The location of your business and the coverage limits you choose can impact the cost of commercial auto insurance. Areas with higher accident rates or crime rates may result in higher premiums. Additionally, increasing your coverage limits to ensure adequate protection for your business assets and liabilities will also increase the cost of insurance.

Why is Commercial Auto Insurance More Expensive?

Now that we have explored the factors that contribute to the cost of commercial auto insurance, let’s delve into why it is generally pricier compared to personal auto insurance.

Firstly, commercial vehicles are often subjected to more extensive use compared to personal vehicles. Businesses rely on their vehicles to transport goods, equipment, and employees, leading to increased mileage and exposure to potential accidents. The higher usage and exposure to risks contribute to higher insurance premiums.

Secondly, commercial vehicles are typically larger and heavier than personal vehicles. This means that in the event of an accident, the potential for damage, injuries, and property loss is greater. Insurance companies take these factors into account when determining the cost of coverage. The higher potential for costly claims translates to higher premiums for commercial auto insurance.

Additionally, commercial auto insurance policies often provide higher liability limits compared to personal auto insurance. This is because businesses have more significant assets at risk and may face larger liability claims in the event of an accident. The increased coverage limits contribute to the higher cost of commercial auto insurance.

The Value of Comprehensive Coverage

While commercial auto insurance may be more expensive, it is crucial for businesses to recognize the value it provides. Comprehensive coverage protects your business assets, vehicles, and employees in the event of accidents, property damage, theft, or injuries. Investing in robust commercial auto insurance ensures that your business remains protected and can continue operations even in challenging situations.

Benefits of Commercial Auto Insurance

Commercial auto insurance offers several benefits that make it a worthwhile investment for businesses. Here are some key advantages:

Asset protection: Commercial auto insurance provides coverage for your business vehicles, ensuring that any damage or loss is financially compensated. This protects your investment and allows you to quickly get back on track.

Liability coverage: Commercial auto insurance also offers liability coverage in the event that your business is held responsible for causing property damage or bodily injury to others. This coverage helps cover legal expenses, medical bills, and potential lawsuits.

Employee protection: If your employees are involved in an accident while driving for work purposes, commercial auto insurance provides coverage for their medical expenses and any potential liability claims.

Business continuity: Having comprehensive commercial auto insurance ensures that your business can continue operations even in the face of unexpected events. It provides peace of mind, knowing that your vehicles and employees are protected, and any potential financial losses are mitigated.

In conclusion, commercial auto insurance is more expensive due to various factors such as the nature of the business, vehicle types and usage, driving records and experience, location, and coverage limits. The higher risks and potential for more significant claims make commercial coverage pricier compared to personal auto insurance. However, the benefits and protection it offers to businesses make it a necessary investment. By understanding the factors influencing the cost and the value of comprehensive coverage, businesses can make informed decisions when it comes to protecting their vehicles and assets.

Key Takeaways: Is Commercial Auto Insurance More Expensive?

- Commercial auto insurance tends to be more expensive than personal auto insurance.

- Factors that contribute to higher costs include increased risk, higher coverage limits, and specialized vehicles.

- Insurers consider the type of business, driving history, and location when determining premium rates.

- Comparing quotes from multiple insurance providers can help find more affordable options.

- Implementing risk management strategies, such as driver training and safety measures, can help lower insurance costs.

Frequently Asked Questions

Why is commercial auto insurance more expensive than personal auto insurance?

Commercial auto insurance is typically more expensive than personal auto insurance due to several factors. Firstly, commercial vehicles are often used for business purposes and may be exposed to higher risks on the road. This increased risk can result in higher premiums to cover potential damages or liability claims.

Additionally, commercial vehicles often have higher coverage limits than personal vehicles. This is because businesses may require more comprehensive coverage to protect their assets and operations. The higher coverage limits contribute to the higher cost of commercial auto insurance.

What factors affect the cost of commercial auto insurance?

Several factors can influence the cost of commercial auto insurance. One of the main factors is the type of business and the industry it operates in. Certain industries may have higher risks associated with their operations, such as transportation or construction, which can lead to higher insurance premiums.

Other factors that can impact the cost include the number of vehicles insured, the driving records of the drivers, the location of the business, and the types of vehicles being insured. Insurance companies will assess these factors to determine the level of risk and calculate the appropriate premium.

Are there any discounts available for commercial auto insurance?

Yes, there are often discounts available for commercial auto insurance. Insurance companies may offer discounts for businesses that have a good claims history, implement safety measures, or have multiple policies with the same insurer. These discounts can help lower the overall cost of commercial auto insurance.

It is recommended to speak with an insurance agent or broker to explore the available discounts and ensure that your business is taking advantage of any cost-saving opportunities.

How can businesses reduce the cost of commercial auto insurance?

There are several strategies that businesses can use to reduce the cost of commercial auto insurance. One approach is to implement safety measures, such as driver training programs, regular vehicle maintenance, and telematics devices that monitor driving behavior. By demonstrating a commitment to safety, businesses may be able to negotiate lower insurance premiums.

Another option is to shop around and compare quotes from different insurance companies. Each insurer may have their own pricing models and discounts, so it is important to explore multiple options to find the most competitive rates. Finally, bundling multiple policies, such as commercial auto insurance and general liability insurance, with the same insurer can often result in cost savings.

Is it worth investing in commercial auto insurance despite the higher cost?

Yes, investing in commercial auto insurance is essential for businesses that rely on vehicles for their operations. While the cost may be higher compared to personal auto insurance, the coverage provided by commercial auto insurance is tailored to the unique risks faced by businesses.

Without adequate insurance, a single accident or liability claim could have devastating financial consequences for a business. Commercial auto insurance provides protection against property damage, bodily injury, legal expenses, and other potential risks, giving business owners peace of mind and financial security.

Final Thought: Is Commercial Auto Insurance More Expensive?

When it comes to the cost of commercial auto insurance, many business owners wonder if it’s worth the investment. Well, let me break it down for you. While commercial auto insurance may seem pricier compared to personal car insurance, it’s important to understand the factors that contribute to this difference.

Firstly, commercial vehicles are often used for business purposes, which means they tend to log more miles on the road. Increased mileage can lead to a higher risk of accidents, resulting in higher insurance premiums. Additionally, commercial vehicles may carry valuable cargo or equipment, making them more attractive to thieves, which can also impact insurance costs.

Moreover, commercial auto insurance offers coverage for multiple drivers and vehicles under one policy. This comprehensive coverage ensures that your business is protected against potential liabilities, including property damage, bodily injury, and legal expenses. So, while the upfront cost may be higher, commercial auto insurance provides the necessary protection to safeguard your business assets and operations.

In conclusion, while commercial auto insurance may be more expensive than personal car insurance, it is a crucial investment for businesses that rely on vehicles for their operations. The increased risk associated with commercial use and the comprehensive coverage it offers make it a necessary expense. So, if you want to protect your business and ensure its smooth operation, commercial auto insurance is definitely worth considering.