How To Manage Foreign Exchange Risk?

Are you ready to dive into the world of foreign exchange risk management? Well, buckle up because I’ve got some valuable insights to share with you. Whether you’re a savvy investor or a business owner expanding into international markets, understanding how to manage foreign exchange risk is crucial to protect your hard-earned money.

So, what exactly is foreign exchange risk? It’s the potential loss that arises from fluctuations in exchange rates between currencies. Imagine this: you’ve made a profitable business deal in a foreign country, but when it’s time to convert those earnings back into your home currency, the exchange rate takes a nosedive, leaving you with less money than expected. Ouch!

But fear not, my friend, because there are ways to mitigate this risk and safeguard your finances. In this article, we’ll explore practical strategies to manage foreign exchange risk effectively, giving you the confidence to navigate the choppy waters of the currency market. Get ready to discover the secrets of protecting your wealth and maximizing your gains. Let’s dive in!

- Identify the risk: Assess the potential impact of currency fluctuations on your business.

- Hedging strategies: Use financial instruments like forward contracts or options to protect against adverse exchange rate movements.

- Operational strategies: Adjust pricing, sourcing, or manufacturing locations to minimize exposure.

- Monitor and evaluate: Continuously monitor exchange rates and review your risk management strategies.

Remember, managing foreign exchange risk is crucial for businesses involved in international transactions.

Managing Foreign Exchange Risk: A Comprehensive Guide

Foreign exchange risk is a significant concern for businesses operating in the global market. Fluctuations in exchange rates can have a profound impact on a company’s financial performance and stability. However, with proper risk management strategies in place, businesses can mitigate the potential negative effects of foreign exchange risk. In this article, we will explore various techniques and best practices to effectively manage foreign exchange risk.

The Importance of Foreign Exchange Risk Management

Foreign exchange risk refers to the potential losses that can occur due to changes in exchange rates. For multinational companies, this risk arises when they have transactions denominated in a currency other than their functional currency. It is crucial to manage foreign exchange risk because it can impact a company’s profitability, cash flow, and overall financial health.

One of the key reasons why foreign exchange risk management is essential is the volatility of exchange rates. Exchange rates are influenced by various factors such as economic indicators, geopolitical events, and market sentiment. These factors can cause exchange rates to fluctuate rapidly, making it challenging for businesses to predict and plan for future currency movements. By implementing effective risk management strategies, businesses can minimize their exposure to these fluctuations and protect their financial interests.

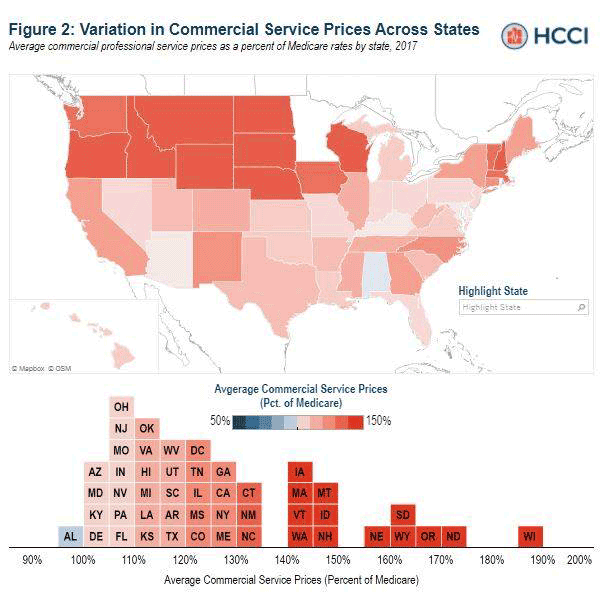

Types of Foreign Exchange Risk

There are several types of foreign exchange risk that businesses need to be aware of and manage. These include transaction risk, translation risk, and economic risk.

Transaction risk arises when a company has outstanding foreign currency transactions that are affected by changes in exchange rates. This type of risk can impact the profitability of individual transactions and can be hedged using various financial instruments.

Translation risk, also known as accounting risk, occurs when a company consolidates financial statements of its foreign subsidiaries. Fluctuations in exchange rates can lead to gains or losses in the translation of foreign currency financial statements into the reporting currency.

Economic risk, also referred to as operating risk, is the risk that arises from changes in exchange rates impacting a company’s competitive position and future cash flows. Economic risk is more long-term in nature and requires a comprehensive evaluation of a company’s exposure to different currencies and markets.

Effective Strategies for Managing Foreign Exchange Risk

Managing foreign exchange risk requires a proactive approach and the implementation of various strategies. Let’s explore some of the most effective techniques for mitigating the impact of foreign exchange risk.

1. Identify and Measure Risk Exposure

The first step in managing foreign exchange risk is to identify and measure the potential exposure. This involves analyzing the company’s cash flow, balance sheet, and future transactions to determine the extent of its exposure to fluctuating exchange rates. By quantifying the risk exposure, businesses can develop appropriate risk management strategies.

2. Hedging

Hedging is a common technique used to reduce foreign exchange risk. It involves entering into financial contracts, such as forwards, options, or futures, to protect against adverse currency movements. Hedging allows businesses to lock in exchange rates for future transactions, providing certainty and stability in an uncertain currency market.

3. Diversification

Diversification is another effective strategy for managing foreign exchange risk. By diversifying their operations across different countries and currencies, businesses can reduce their exposure to any single currency. This approach helps mitigate the impact of adverse exchange rate movements on a company’s overall financial performance.

4. Netting

Netting involves offsetting payables and receivables denominated in the same currency to reduce foreign exchange risk. By consolidating transactions in a single currency, businesses can minimize the impact of exchange rate fluctuations and simplify their foreign currency management processes.

5. Centralized Treasury Management

Centralized treasury management involves consolidating all foreign exchange activities and decision-making within a central treasury function. This approach allows for better coordination, control, and visibility over foreign exchange risk. It also enables businesses to leverage economies of scale and optimize their hedging strategies.

6. Continuous Monitoring and Analysis

Managing foreign exchange risk is an ongoing process that requires continuous monitoring and analysis. Businesses should closely track exchange rate movements, economic indicators, and market trends to identify potential risks and opportunities. Regular analysis of risk exposure and performance metrics can help businesses make informed decisions and adjust their risk management strategies accordingly.

Conclusion

In today’s globalized business environment, managing foreign exchange risk is crucial for maintaining financial stability and profitability. By implementing effective risk management strategies such as identifying and measuring risk exposure, hedging, diversification, netting, centralized treasury management, and continuous monitoring, businesses can navigate the challenges posed by foreign exchange fluctuations and protect their bottom line. Remember, the key to successful risk management lies in proactive planning, analysis, and adaptation to changing market conditions.

Key Takeaways: How to Manage Foreign Exchange Risk?

- Understand the importance of foreign exchange risk management.

- Diversify your investments across different currencies.

- Implement hedging strategies to protect against currency fluctuations.

- Stay updated on global economic and political events that may impact exchange rates.

- Consider working with a professional financial advisor to navigate foreign exchange risks.

Frequently Asked Questions

What is foreign exchange risk?

Foreign exchange risk refers to the potential financial loss that can occur as a result of fluctuations in currency exchange rates. When a company operates in multiple countries or engages in international trade, it is exposed to the risk of currency movements that can impact its profits and cash flows.

For example, if a company buys goods from a foreign supplier and the value of its domestic currency depreciates against the supplier’s currency, the cost of the goods will increase. This can erode the company’s profit margins and make its products more expensive for customers.

What are the different types of foreign exchange risk?

There are three main types of foreign exchange risk:

1. Transaction risk: This occurs when a company has outstanding foreign currency obligations or receivables that are affected by exchange rate fluctuations.

2. Translation risk: This risk arises from the conversion of a company’s financial statements from one currency to another, particularly for multinational companies with subsidiaries in different countries.

3. Economic risk: Also known as operating risk, this refers to the potential impact of exchange rate fluctuations on a company’s future cash flows, market share, and competitive position.

How can companies manage foreign exchange risk?

Companies can employ various strategies to manage foreign exchange risk:

1. Hedging: This involves using financial instruments such as forward contracts, options, or futures to protect against adverse exchange rate movements. By entering into these contracts, companies can lock in a specific exchange rate for future transactions.

2. Diversification: Companies can diversify their operations across different countries and currencies to reduce their exposure to any single currency. This can help mitigate the impact of exchange rate fluctuations.

3. Netting: Netting involves offsetting foreign currency payables against receivables in the same currency. By doing so, companies can reduce their exposure to exchange rate movements and minimize the need for currency conversions.

Why is risk assessment important in managing foreign exchange risk?

Risk assessment is crucial in managing foreign exchange risk as it helps companies identify and evaluate their exposure to different types of risks. By understanding the potential impact of currency fluctuations on their financial performance, companies can develop effective risk management strategies.

Through risk assessment, companies can determine the appropriate level of hedging, diversification, and netting required to mitigate foreign exchange risk. It also enables them to prioritize their risk management efforts and allocate resources accordingly.

What are the potential benefits of managing foreign exchange risk?

Managing foreign exchange risk can bring several benefits to companies:

1. Protection of profits: By hedging against adverse currency movements, companies can safeguard their profit margins and ensure the predictability of cash flows.

2. Competitive advantage: Effective management of foreign exchange risk can give companies a competitive edge by enabling them to offer stable pricing to customers, regardless of currency fluctuations.

3. Improved financial planning: Minimizing the impact of exchange rate fluctuations allows companies to plan their budgets, investments, and expansion strategies more accurately, leading to better financial outcomes.

Final Summary

Managing foreign exchange risk can be a daunting task, but with the right strategies in place, you can navigate the turbulent waters of currency fluctuations. By understanding the key principles and implementing effective risk management techniques, you can protect your business from potential losses and even capitalize on favorable exchange rate movements.

One of the most important steps in managing foreign exchange risk is to identify and assess your exposure. By analyzing your transactions and determining which currencies are involved, you can gain a clear understanding of the potential risks you may face. Once you have identified your exposure, you can then implement various hedging techniques such as forward contracts, options, or currency swaps to mitigate the impact of exchange rate fluctuations.

Another crucial aspect of managing foreign exchange risk is staying informed and proactive. Keeping a close eye on global economic trends, geopolitical events, and central bank policies can help you anticipate and react to potential currency movements. By staying ahead of the game, you can make informed decisions and adjust your risk management strategies accordingly.

In conclusion, managing foreign exchange risk requires a proactive and strategic approach. By identifying your exposure, implementing effective hedging techniques, and staying informed, you can minimize the impact of currency fluctuations on your business. Remember, the key is to be prepared and adaptable in an ever-changing global market.