How Much Is A Million Dollar Commercial Insurance Policy?

A million dollar commercial insurance policy may seem like a significant investment, but when considering the potential risks and liabilities that businesses face, it becomes clear that this coverage is essential. Did you know that a single lawsuit or disaster could lead to financial ruin for a company without adequate insurance? As businesses grow and expand, the need for comprehensive insurance coverage becomes even more crucial to protect against unforeseen events.

When considering the cost of a million dollar commercial insurance policy, it’s important to understand the factors that influence the premium. Insurance providers consider the type of business, its size, location, industry risks, and claims history when determining the cost. Additionally, the coverage limits, deductibles, and optional endorsements can also impact the overall price. While a million dollar policy may seem expensive, the financial security and peace of mind it provides in the face of potential losses or claims are invaluable.

A million-dollar commercial insurance policy can vary in cost depending on various factors such as the nature of your business, the industry, and the coverage you require. Generally, premiums for such policies can range from a few thousand to tens of thousands of dollars annually. It’s crucial to work with an experienced insurance broker who can assess your specific needs and provide accurate quotes from multiple insurers. Remember, the cost is justified by the financial security it offers against potential lawsuits, property damage, or other unforeseen events.

Understanding the Factors Affecting the Cost of a Million Dollar Commercial Insurance Policy

A million dollar commercial insurance policy is a significant investment for businesses, providing coverage against various risks and liabilities. However, the cost of such a policy can vary based on several factors. Understanding these factors can help businesses make informed decisions when it comes to purchasing commercial insurance. In this article, we will explore the different elements that influence the cost of a million dollar commercial insurance policy.

Nature of the Business

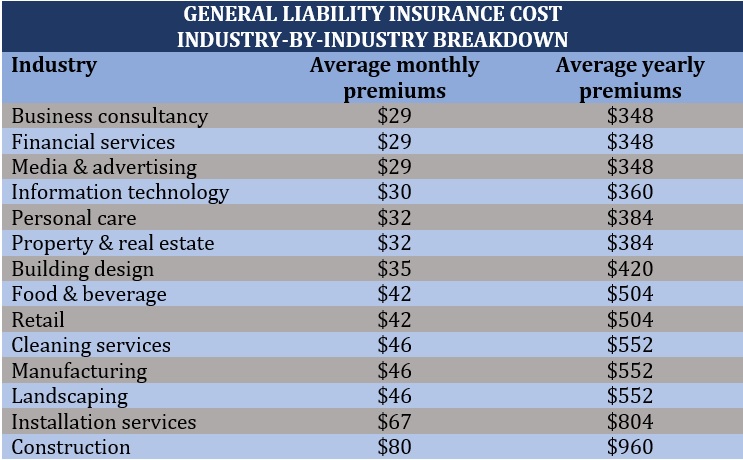

The nature of your business is a critical factor that impacts the cost of a million dollar commercial insurance policy. Insurance companies assess the risk associated with different industries and adjust premiums accordingly. Businesses operating in high-risk sectors, such as construction or healthcare, are likely to pay higher premiums compared to low-risk industries like consulting or retail.

Additionally, the size of your business and annual revenue can also play a role in determining the cost of the policy. Larger businesses with higher revenues may require more coverage and therefore pay a higher premium. It’s essential to accurately assess your business’s nature and size to ensure you have adequate coverage without overpaying for unnecessary protection.

Moreover, the location of your business can impact the cost of insurance. If your business operates in an area prone to natural disasters or has a higher crime rate, insurance companies may charge higher premiums as the risks associated with these locations are higher. Therefore, businesses located in high-risk areas may need to allocate a higher budget for their commercial insurance policy.

Lastly, the number of years your business has been operating also affects the insurance premium. Start-ups or businesses with a limited operating history may be considered riskier by insurance companies, resulting in higher premiums. As your business establishes a track record, insurance providers may offer more competitive rates.

Coverage Types

The range of coverage types included in a million dollar commercial insurance policy affects its cost. Insurance policies typically encompass several types of coverage, including general liability, professional liability, property damage, and workers’ compensation, among others. The more comprehensive the coverage, the higher the premium is likely to be.

Businesses can customize their insurance policies based on their specific needs and risk factors, such as adding additional coverage for cyber liability or business interruption. However, each addition of coverage will result in an increase in premiums. It’s crucial to assess your business’s requirements and consult with insurance professionals to determine the appropriate coverage types to include in your policy.

Insurance companies also consider policy limits when determining the cost. A million dollar commercial insurance policy acts as the maximum limit of coverage per occurrence or aggregate limit over a specified period. Higher policy limits will lead to higher premiums, as the insurance company assumes a greater potential liability.

Risk Factors

Insurance companies assess various risk factors associated with your business to calculate the cost of a million dollar commercial insurance policy. These risk factors include the history of claims or lawsuits filed against your business, previous insurance coverage, and compliance with safety regulations. If your business has a history of claims, insurance providers may increase premiums to offset the perceived risk.

Safety practices implemented by your business can also affect the cost of insurance. Demonstrating compliance with safety regulations, maintaining a safe work environment, and implementing risk management strategies may lead to lower insurance premiums. Insurance companies are more likely to offer competitive rates to businesses that actively manage their risks.

Additionally, the type of products or services your business offers can influence the cost of insurance. If your business manufactures and distributes products, insurance providers will assess the potential product liability risks. Similarly, service-based businesses may be evaluated based on the potential errors or omissions that could occur.

Insurance Provider and Policy Options

The insurance company you choose to work with and the specific policy options you select can also impact the cost of a million dollar commercial insurance policy. Insurance providers have different pricing models and underwriting criteria, resulting in variations in premiums. It’s advisable to obtain quotes from multiple providers to compare pricing and coverage options.

Furthermore, the deductible amount you select can affect the premium. A deductible is the amount you pay out of pocket before the insurance coverage kicks in. Higher deductibles typically lead to lower premiums, as you are assuming a larger portion of the risk. However, it’s essential to assess your financial capability to cover the deductible in the event of a claim.

Discounts and credits offered by insurance companies can also reduce the overall premium cost. Insurance providers may offer discounts for businesses with a strong safety record, membership in professional associations, or bundling multiple policies with the same provider. It’s important to inquire about available discounts to maximize cost savings while maintaining adequate coverage.

The Importance of Evaluating Insurance Needs and Consulting Professionals

When considering the cost of a million dollar commercial insurance policy, it’s crucial for businesses to evaluate their insurance needs carefully. Assessing the nature of your business, risk factors, coverage types required, and budgetary constraints will help you make an informed decision. Consulting with insurance professionals can provide valuable insights and ensure you have the appropriate coverage at a reasonable cost.

Overview of the Cost of a Million Dollar Commercial Insurance Policy

When it comes to protecting your business, a million dollar commercial insurance policy can provide the coverage you need. However, it is important to understand the cost associated with such a policy. The actual cost of a million dollar commercial insurance policy can vary depending on several factors, including:

- The type of business you operate

- The industry you are in

- The size and location of your business

- Your claims history

Generally, the cost of a million dollar commercial insurance policy can range from $1,000 to $5,000 annually. However, it is important to note that this is just an estimate and your actual premium may vary. To get an accurate quote for your business, it is recommended to reach out to insurance providers and provide them with the necessary information related to your business.

It is important to consider the potential risks your business may face and the coverage you need when determining the appropriate insurance policy. A million dollar commercial insurance policy can provide financial protection and peace of mind in the event of unforeseen circumstances or liability claims.

Key Takeaways

- A million dollar commercial insurance policy typically costs between $1,000 and $3,000 per year.

- The exact cost depends on various factors such as the type of business, location, and coverage limits.

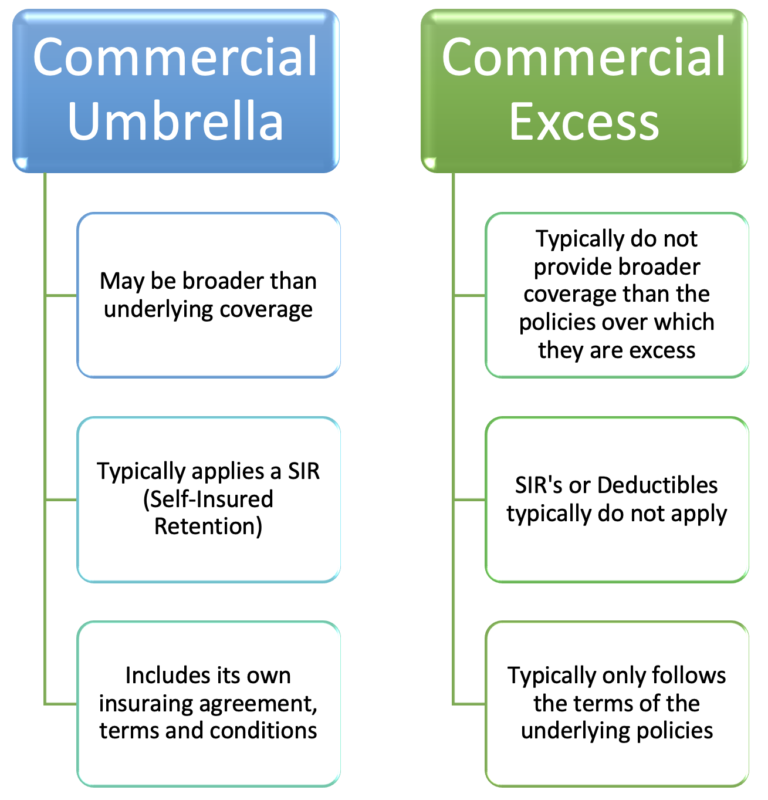

- Additional coverage options, such as umbrella policies, can increase the cost.

- Insurance companies will consider the business’s industry risk and claims history in determining the premium.

- Working with an insurance broker can help businesses find the best coverage at the most competitive price.

Frequently Asked Questions

Here are some frequently asked questions about the cost of a million dollar commercial insurance policy:

1. What factors determine the cost of a million dollar commercial insurance policy?

The cost of a million dollar commercial insurance policy can vary depending on several factors. These factors include the type of business you operate, the size of your business, the industry you are in, the location of your business, and the coverage limits you choose. Each of these factors will be assessed by insurance providers to determine the premium you will need to pay.

Additionally, the claims history of your business, the risk profile of your industry, and the level of coverage you need will also impact the cost of the policy. It’s important to work with an insurance agent or broker who can assess your specific needs and provide you with accurate quotes based on your unique circumstances.

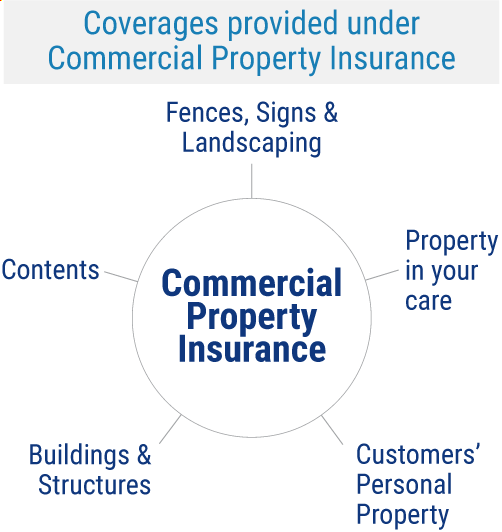

2. Are there different types of million dollar commercial insurance policies?

Yes, there are different types of million dollar commercial insurance policies. Some common types include general liability insurance, professional liability insurance, commercial property insurance, commercial auto insurance, and workers’ compensation insurance. The type of policy you need will depend on the nature of your business and the risks associated with it.

Each type of insurance policy will have its own cost structure based on the coverage it provides. For example, general liability insurance typically covers bodily injury and property damage claims, while professional liability insurance protects against claims of professional negligence or errors and omissions. The cost of these policies will vary based on the specific coverage and limits you require.

3. Can I get a million dollar commercial insurance policy for a small business?

Yes, it is possible to get a million dollar commercial insurance policy for a small business. Insurance providers offer coverage options to businesses of all sizes, including small businesses. However, the cost of the policy may be influenced by the size and nature of your business.

Smaller businesses may have different risk profiles compared to larger businesses, which can affect the premium. It’s important to work with an insurance provider who understands the needs of small businesses and can provide tailored coverage options that meet your budget and requirements.

4. Are there any ways to reduce the cost of a million dollar commercial insurance policy?

Yes, there are ways to potentially reduce the cost of a million dollar commercial insurance policy. One way is to bundle multiple insurance policies with the same provider. By combining policies such as general liability, property insurance, and commercial auto insurance, you may be eligible for a multi-policy discount.

Additionally, implementing risk management strategies and maintaining a good claims history can also help lower your insurance premium. Taking steps to minimize risks, such as installing security systems or implementing safety protocols, can demonstrate to insurance providers that you are proactive in preventing potential claims.

5. How can I find the best deal on a million dollar commercial insurance policy?

To find the best deal on a million dollar commercial insurance policy, it’s important to shop around and compare quotes from multiple insurance providers. Working with an insurance agent or broker can help streamline this process, as they have access to multiple insurance companies and can provide you with various options to choose from.

It’s also important to carefully review the terms and conditions of each policy to ensure it meets your needs and offers adequate coverage. Don’t solely focus on the price; consider the reputation and financial stability of the insurance company as well. By conducting thorough research and due diligence, you can find the best combination of coverage and cost for your business.

How Much Does Commercial Insurance Cost For Cargo Van Courier Business ($1,000,000 \u0026 $100k Cargo)

So, in conclusion, the cost of a million-dollar commercial insurance policy can vary depending on several factors, such as the type of business, coverage needs, and location. It’s essential to work with a reputable insurance provider who can offer a customized policy that meets your specific needs and budget.

Remember that insurance premiums are based on risk factors, and businesses in high-risk industries or locations may have higher premiums. Additionally, it’s important to regularly review and update your policy to ensure that you have adequate coverage as your business grows and evolves. By investing in a comprehensive insurance policy, you can protect your business from unexpected financial losses and liabilities.