Do I Need Commercial Insurance For Instacart?

When it comes to working as an Instacart shopper, one question that often arises is whether you need commercial insurance. And the answer may surprise you. While Instacart provides some insurance coverage for its shoppers, it may not be enough to fully protect you in the event of an accident or injury. So, what do you need to know about commercial insurance for Instacart?

Instacart’s coverage includes liability insurance, which covers damage caused to others or their property while you’re shopping or delivering. However, this coverage is limited, and if you are found at fault in an accident, you may be held personally responsible for damages. A commercial insurance policy tailored for Instacart shoppers can provide additional protection and help fill in the gaps, giving you peace of mind as you go about your work.

Commercial insurance is essential for Instacart drivers. While Instacart provides some coverage, it may not be sufficient in certain situations. Commercial insurance protects you in case of accidents, injuries, or damage that may occur while making deliveries. It also covers your vehicle, ensuring you’re financially protected. Without commercial insurance, you could be held personally liable for any damages or injuries, which can lead to significant financial loss. Stay protected and get the right commercial insurance to safeguard your business and peace of mind.

Understanding the Importance of Commercial Insurance for Instacart

Instacart has become increasingly popular in recent years as a convenient way to get groceries and other essentials delivered straight to your doorstep. As a shopper or driver for Instacart, you may wonder if you need commercial insurance to protect yourself and your vehicle while working. While Instacart provides some insurance coverage for their shoppers, it is important to understand the limitations and consider obtaining additional commercial insurance for added protection. This article will delve into the reasons why commercial insurance is crucial for Instacart shoppers and drivers.

Coverage Gaps in Personal Auto Insurance

One of the main reasons why Instacart shoppers and drivers need commercial insurance is because personal auto insurance policies usually exclude coverage for business or commercial use. If you rely solely on your personal auto insurance while working for Instacart, you may find that your policy doesn’t cover accidents or damages that happen while using your vehicle for business purposes. This means that any damage to your vehicle or injuries sustained in an accident may not be covered by your personal auto insurance.

Personal auto insurance policies are designed to cover personal use of the vehicle, such as commuting to work or running errands. However, when you are using your vehicle as a shopper or driver for Instacart, it is considered a commercial activity. This creates a coverage gap, leaving you vulnerable to significant financial losses in the event of an accident or damage to your vehicle.

By obtaining commercial insurance specifically tailored for Instacart shoppers and drivers, you can bridge this coverage gap and ensure that you have the necessary protection in case of an accident or damage to your vehicle while working. Commercial insurance provides coverage for business use of your vehicle, including when you are using it for Instacart deliveries. It offers a higher level of coverage and protection compared to personal auto insurance.

Types of Commercial Insurance for Instacart Shoppers and Drivers

When considering commercial insurance for Instacart, there are a few types of coverage to consider:

- Commercial Auto Insurance: This type of insurance provides coverage for accidents and damages that occur while using your vehicle for business purposes. It can cover bodily injury liability, property damage liability, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

- Non-Owned Auto Insurance: If you use a rental vehicle or borrow someone else’s vehicle for Instacart deliveries, non-owned auto insurance provides coverage in case of an accident or damage to the vehicle.

- General Liability Insurance: This type of insurance provides coverage for third-party bodily injury or property damage claims that may occur while you are working for Instacart.

It is important to consult with an insurance professional specializing in commercial insurance to determine the appropriate coverage for your specific needs as an Instacart shopper or driver.

Benefits of Commercial Insurance for Instacart Shoppers and Drivers

Obtaining commercial insurance for your Instacart activities offers several benefits:

- Peace of Mind: With commercial insurance, you can have peace of mind knowing that you are protected in the event of an accident or damage to your vehicle while working for Instacart. You won’t have to worry about costly repairs or medical expenses.

- Comprehensive Coverage: Commercial insurance offers a higher level of coverage compared to personal auto insurance. It can cover a range of scenarios, including accidents, theft, vandalism, and more.

- Legal Compliance: Depending on your location, commercial insurance may be legally required for businesses or individuals engaging in delivery services. By having the appropriate commercial insurance, you can ensure that you are compliant with local regulations.

- Business Protection: Commercial insurance not only protects you and your vehicle but also provides coverage for potential liability claims. If a customer claims injury or property damage due to your actions while working for Instacart, commercial insurance can help cover the costs of legal defense and potential settlements.

Considerations when Choosing Commercial Insurance

When selecting commercial insurance for Instacart, keep the following considerations in mind:

- Policy Limits: Ensure that the policy’s coverage limits are sufficient to protect you in case of a major incident. Consider the potential costs of vehicle repairs, medical expenses, and legal defense.

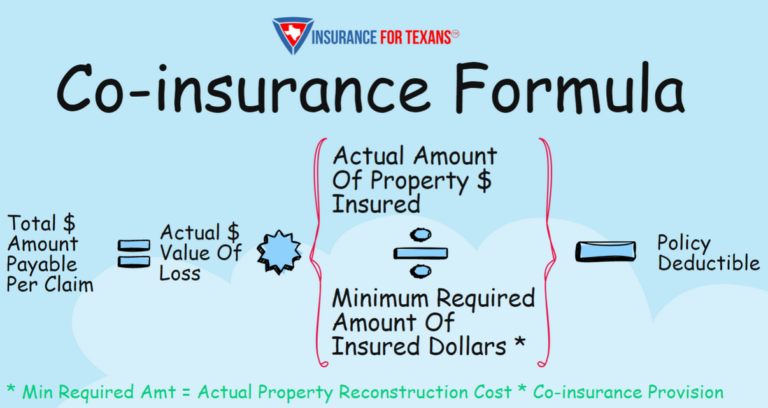

- Deductibles: Understand the deductibles associated with the commercial insurance policy. A higher deductible may mean lower premiums, but it also means higher out-of-pocket expenses in the event of a claim.

- Exclusions: Take note of any exclusions in the policy, such as coverage limitations for certain types of accidents or incidents. Be aware of any restrictions on vehicle age or mileage.

It is essential to thoroughly research and compare different commercial insurance policies to find the one that best suits your needs as an Instacart shopper or driver. Consult with an insurance professional who can guide you in making an informed decision.

In conclusion, having commercial insurance for Instacart shoppers and drivers is highly recommended due to the coverage gaps in personal auto insurance policies. Commercial insurance provides the necessary protection and peace of mind while working for Instacart, covering accidents, damages, liability claims, and more. By understanding the importance of commercial insurance and considering the different types of coverage available, you can ensure that you are adequately protected in your role as an Instacart shopper or driver.

Commercial Insurance for Instacart

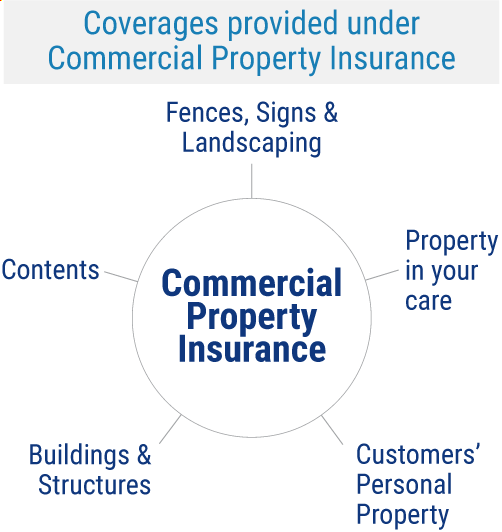

As a professional Instacart shopper, it is important to understand whether you need commercial insurance to protect yourself and your business. Commercial insurance provides coverage for accidents, liability, and property damage that may occur while delivering groceries or operating in-store. While Instacart provides some coverage, it may not be sufficient in every situation.

Before deciding whether to purchase commercial insurance, consider the following factors:

- The amount of coverage provided by Instacart’s insurance policy

- Your personal assets and financial situation

- The specific requirements of your state or local government

- Your willingness to take on the potential risks and expenses

Commercial insurance is designed to provide additional protection and peace of mind for you and your business. It can cover medical expenses, legal fees, and property damage costs that are not covered by Instacart’s insurance policy. It also demonstrates professionalism and responsibility to your customers and potential clients.

Consult with an insurance professional to determine the best commercial insurance policy for your Instacart business. They can help you understand the coverage options and requirements specific to your needs and location. Remember, protecting yourself and your business is essential for long-term success as an Instacart shopper.

Key Takeaways

- Commercial insurance is not required by Instacart, but it is highly recommended.

- Commercial insurance provides coverage for accidents, injuries, and property damage while delivering for Instacart.

- Personal auto insurance may not cover you while using your vehicle for commercial purposes.

- Commercial insurance can protect you from liability claims and lawsuits.

- Commercial insurance can provide coverage for medical expenses and property damage.

Frequently Asked Questions

Here are some commonly asked questions regarding the need for commercial insurance for Instacart:

1. What is commercial insurance for Instacart?

Commercial insurance for Instacart is a type of insurance coverage specifically tailored for individuals who work as independent contractors for the Instacart grocery delivery service. It provides protection against potential liability risks involved in delivering groceries and operating as a personal shopper for customers.

Typically, a commercial insurance policy for Instacart includes general liability coverage, auto liability coverage (if you use your vehicle for deliveries), and workers’ compensation coverage (for injuries sustained while working for Insatcart). It is important to consult with an insurance professional to understand the specific coverage options available and required in your area.

2. Do I need commercial insurance if I work for Instacart?

While Instacart does provide some insurance coverage for their shoppers, it may not be sufficient to cover all potential risks and liabilities. It is recommended to have additional commercial insurance to ensure adequate protection.

Commercial insurance can safeguard you against costly expenses in the event of accidents, injuries, property damage, or lawsuits. It is important to review the terms and conditions of the insurance coverage provided by Instacart and assess if it meets your needs. In many cases, obtaining commercial insurance is a wise decision for the added peace of mind and protection it offers.

3. What if I already have personal auto insurance?

Your personal auto insurance policy may not cover you adequately while performing work-related duties for Instacart. Most personal auto insurance policies have exclusions for using your vehicle for commercial purposes or as part of a delivery service.

If you use your personal vehicle for Instacart deliveries, it is crucial to inform your insurance provider and determine if a commercial auto insurance policy is necessary to ensure proper coverage. Failing to disclose this information could potentially result in denied claims or even cancellation of your personal auto insurance policy.

4. Is commercial insurance for Instacart expensive?

The cost of commercial insurance for Instacart can vary depending on various factors, such as your location, driving history, coverage limits, and the insurance provider. While it may incur an additional expense, it is important to weigh this cost against the potential financial consequences of being underinsured or not having the necessary coverage.

It is advisable to shop around and obtain quotes from multiple insurance providers specializing in commercial insurance for Instacart. This way, you can compare prices and coverage options to find a policy that suits your needs and budget.

5. How can I purchase commercial insurance for Instacart?

To purchase commercial insurance for Instacart, you can start by contacting insurance companies that specialize in providing coverage for independent contractors and delivery drivers. They will guide you through the process, assess your specific needs, and offer suitable policy options.

Be prepared to provide information such as your driving history, the type of vehicle you use for deliveries, the area of operation, and any previous insurance claims. This will help insurance providers determine the appropriate coverage and pricing for your commercial insurance policy.

Normal Insurance will not cover you! (Doordash, Instacart, Uber Eats)

Based on the information provided, it is recommended to have commercial insurance if you are working as a delivery driver for Instacart. While Instacart offers some insurance coverage for their shoppers, it is important to note that this coverage may not be sufficient in certain situations. Commercial insurance can provide you with additional protection and peace of mind in case of accidents, theft, or damage to your vehicle or the goods you are delivering.

Commercial insurance typically covers liability, collision, and comprehensive coverage, which can help mitigate the financial risk associated with accidents or damage during delivery. It is always a good idea to consult with an insurance professional to determine the specific coverage options that best fit your needs as an Instacart shopper.